import pandas as pd

import numpy as np

import datetime, calendar

from statsmodels.tsa.seasonal import seasonal_decompose,STL

from statsmodels.tsa.statespace.tools import diff

from statsmodels.tsa.stattools import acf

from statsmodels.tsa.forecasting.theta import ThetaModel

from statsmodels.tsa.arima.model import ARIMA

from statsmodels.tsa.statespace import exponential_smoothing

from statsmodels.tsa.api import (

ExponentialSmoothing, SimpleExpSmoothing, Holt, STLForecast

)

import pmdarima as pm

from scipy.cluster import hierarchy

from scipy.spatial.distance import pdist,squareform

from ind5003 import ts

import matplotlib.pyplot as plt

import seaborn as sns6 Time Series Analysis

6.1 Exploring Time Series Data

One of the first things that we do when we are given a time series is visualise it. The visualisation is meant to give us an indication of what kinds of techniques would be suitable for forecasting it. In this section, we shall learn several methods to visualise a time series dataset.

When we visualise a time series, we look out for the following features:

- Trend: A trend exists when there is a long-term increase or decrease in the data.

- Level: The level of a series refers to its height on the ordinate axis.

- Seasonal: A seasonal pattern exists when a series is influenced by factors such as quarters of the year, the month, the day of the week, or time of day. Seasonality is always of a fixed and known period.

- Cyclic: A cyclic pattern exists when there are rises and falls that are not of a fixed period.

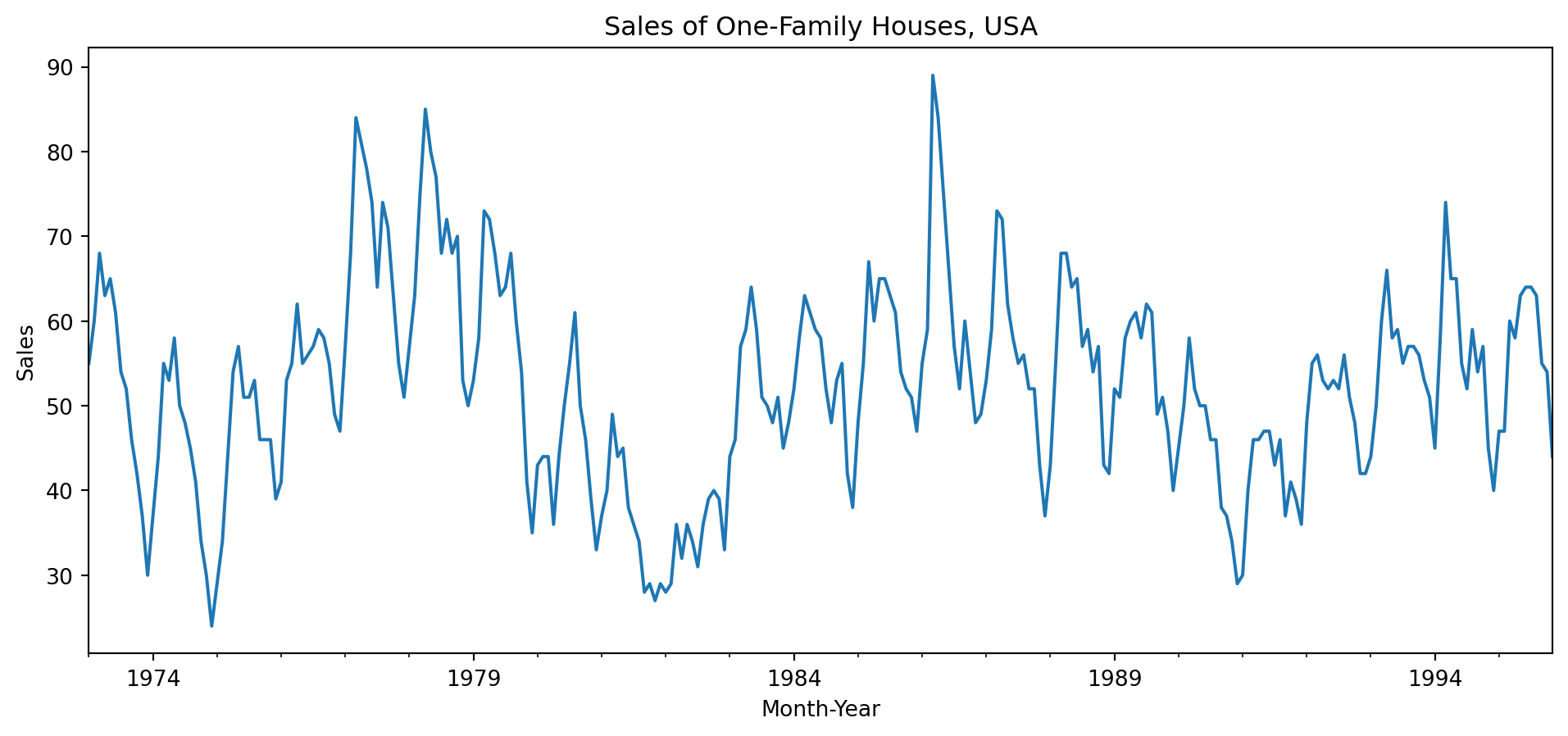

Example 6.1 (Basic plots of housing Data)

This dataset comes from an R package fma. It contains counts of monthly sales of new one-family houses sold in the USA since 1973.

hsales = pd.read_csv('data/hsales.csv', parse_dates=[0])

hsales.set_index('date', inplace=True)

hsales.index.freq = 'MS'

hsales.plot(title='Sales of One-Family Houses, USA', legend=False, figsize=(12,5))

plt.xlabel('Month-Year'); plt.ylabel('Sales');

We observe a strong seasonality within each year. There is some indication of cyclic behaviour every 6 – 10 years. There is no apparent monotonic trend over this period. With pandas objects, we can resample the series. This allows us to compute summaries over time windows that could be of business importance. For instance, we might be interested in a breakdown by quarters instead of months.

With the resample() function, we can perform both downsampling (reducing the frequency of observations) or upsampling (via interpolation or nearest neighbour imputation).

| hsales | |

|---|---|

| date | |

| 1973-01-01 | 55.000000 |

| 1973-01-15 | 54.820513 |

| 1973-01-29 | 54.641026 |

| 1973-02-12 | 54.461538 |

| 1973-02-26 | 54.282051 |

See the page on date-offset objects for details and options on the strings that you can put within the resample method.

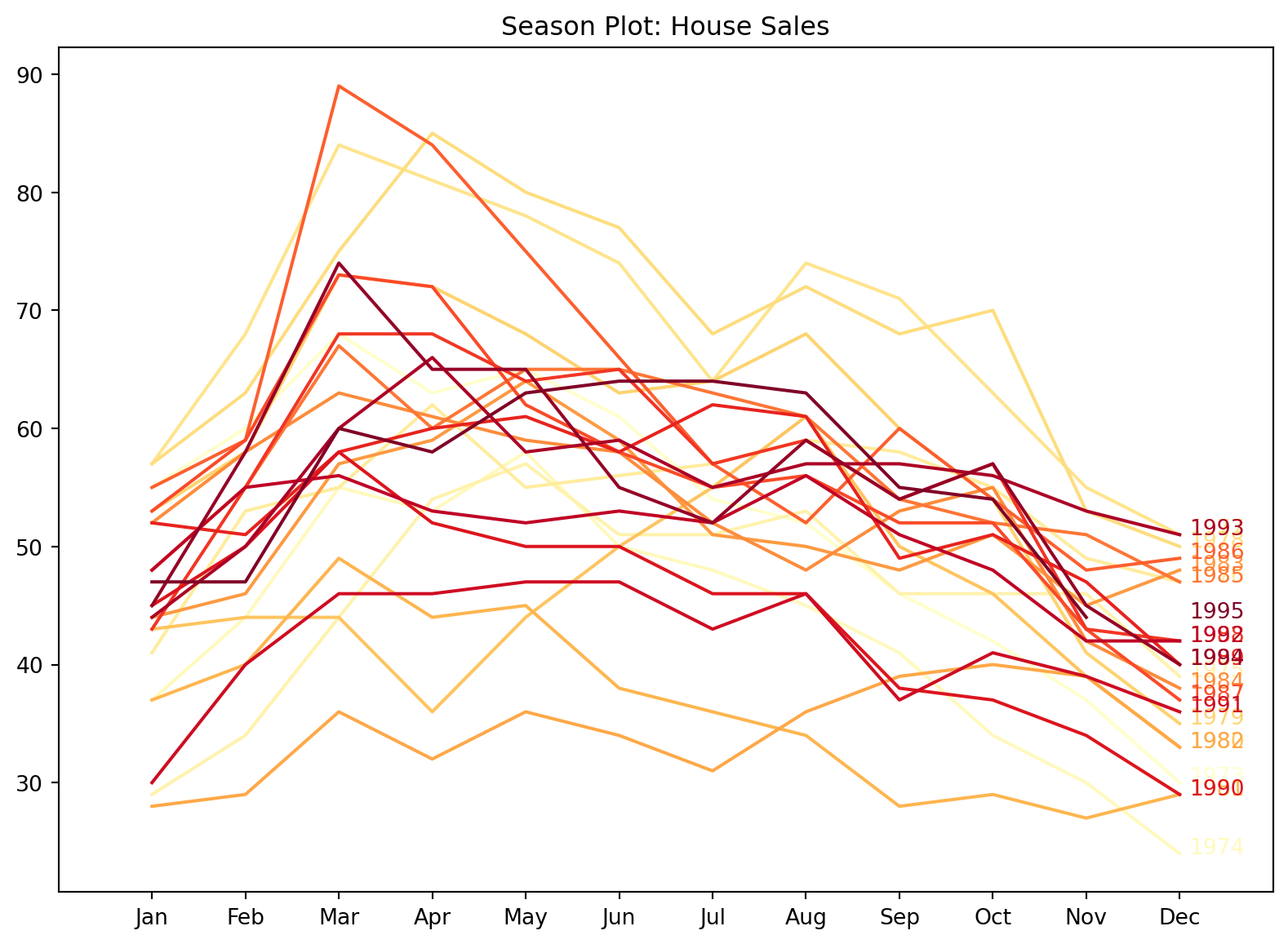

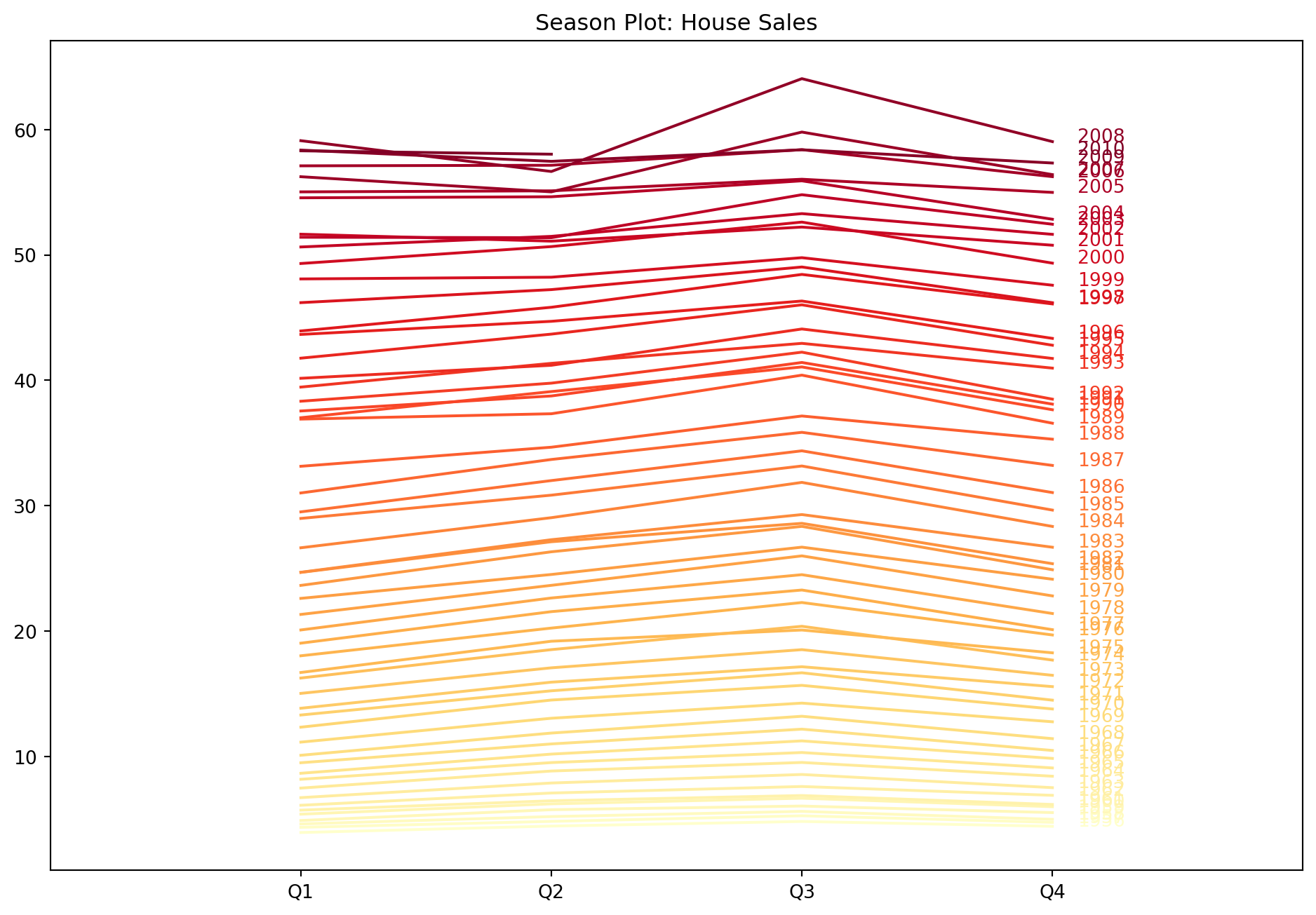

Example 6.2 (Season plots of housing data)

A season plot allows us to visualise what happens within a season. In this case, each line in the graph below traces the behaviour of the series from the beginning of the season till the end (from Jan to Dec).

hsales.loc[:, 'year'] = hsales.index.year

hsales.loc[:, 'month'] = hsales.index.month

yrs = np.sort(hsales.year.unique())

color_ids = np.linspace(0, 1, num=len(yrs))

colors_to_use = plt.cm.YlOrRd(color_ids)

plt.figure(figsize=(10, 7))

for i,yr in enumerate(yrs):

df_tmp = hsales.loc[hsales.year == yr, :]

plt.plot(df_tmp.month, df_tmp.hsales, color=colors_to_use[i]);

plt.text(12.1, df_tmp.hsales.iloc[-1], str(yr), color=colors_to_use[i])

plt.title('Season Plot: House Sales')

plt.xlim(0, 13)

plt.xticks(np.arange(1, 13), calendar.month_abbr[1:13]);

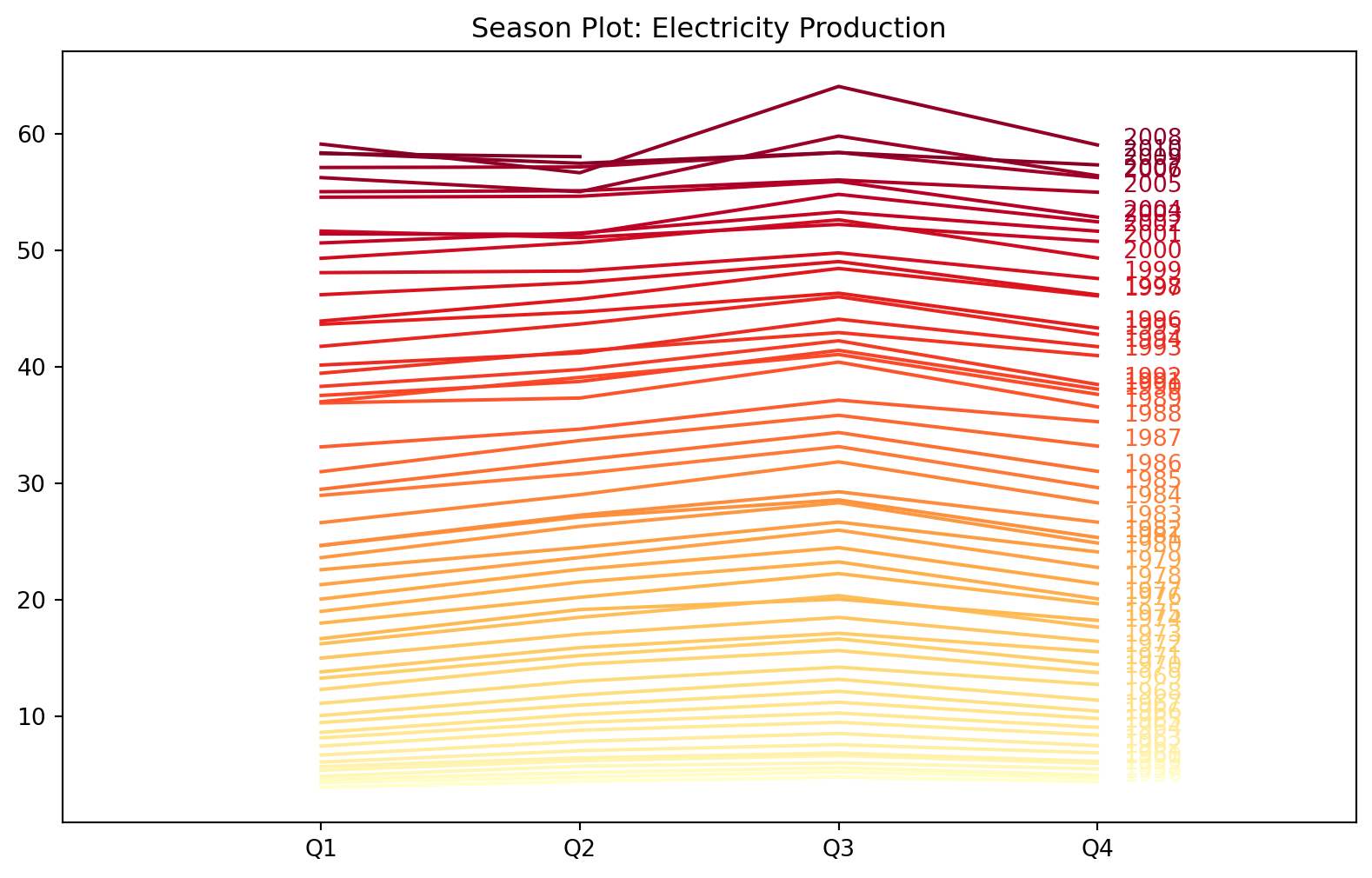

In general, from Figure 6.1, it looks like there is a peak around Feb to March, after which sales descend until the next January. Using a colour map with colours that we can “order” allows us to identify a trend across seasons. In this case, there isn’t one, but if you take a look at Figure 6.2, you will see a clear association between the colour of line and level of each series within a year.

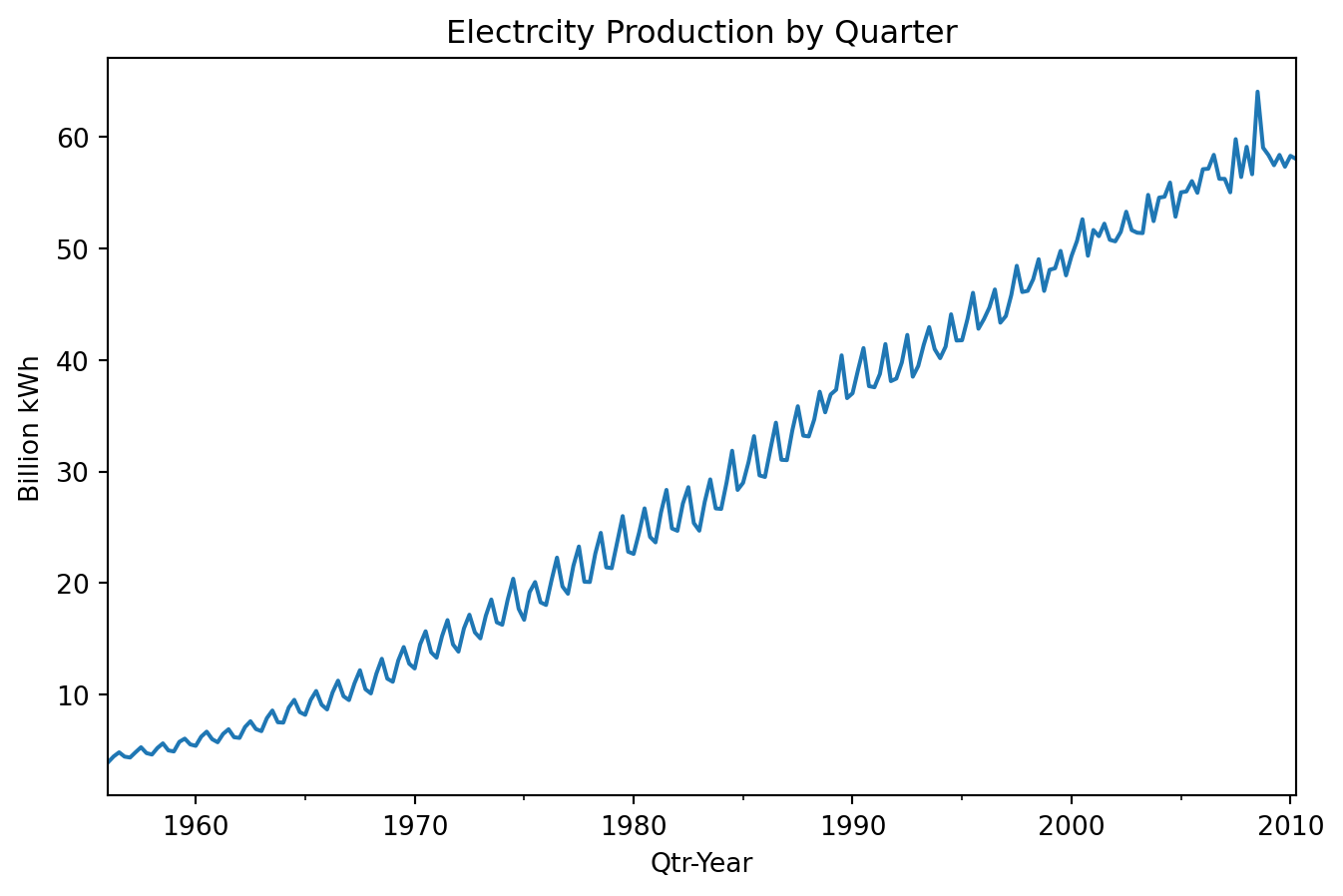

Example 6.3 (Australian quarterly electricity production)

This dataset is from another R package: fpp2. It records quarterly electric production in Australia (in billion kWh) from 1965 till now.

qau = pd.read_csv('data/qauselec.csv', parse_dates=[0])

qau.set_index('date', inplace=True)

qau.index.freq = 'QS'

qau.plot(figsize=(8,4), title='Electrcity Production by Quarter', legend=False)

plt.xlabel('Qtr-Year'); plt.ylabel('Billion kWh');

There is a strong increasing trend. There is strong seasonality, and there is no evidence of cyclic behaviour.

qau2 = qau.copy()

qau2.loc[:, 'year'] = qau2.index.year

qau2.loc[:, 'qtr'] = qau2.index.quarter

yrs = np.sort(qau2.year.unique())

color_ids = np.linspace(0, 1, num=len(yrs))

colors_to_use = plt.cm.YlOrRd(color_ids)

plt.figure(figsize=(10, 6))

for i,yr in enumerate(yrs):

df_tmp = qau2.loc[qau2.year == yr, :]

plt.plot(df_tmp.qtr, df_tmp.kWh, color=colors_to_use[i]);

plt.text(4.1, df_tmp.kWh.iloc[-1], str(yr), color=colors_to_use[i])

plt.title('Season Plot: Electricity Production')

plt.xlim(0, 5)

plt.xticks(np.arange(1, 5), ['Q1', 'Q2', 'Q3', 'Q4']);

Most time series models are autoregressive in nature. This means that they attempt to predict future observations based on previous ones. The observations from the past could be from the time series that we are interested in, or they could be from other time series that we believe are related.

When beginning with model fitting, we would want to have some idea about the extent to which past observations affect the current one. In other words, how many of the past observations should we include when forecasting new observations? Lag plots and autocorrelation functions (acf) are the tools that we use to answer this question.

If we denote the observation of a time series as \(y_t\), then a lag plot at lag \(k, k > 0\) is a scatter plot of \(y_t\) against \(y_{t-k}\). It allows us to visually assess if the observations that are \(k\) units of time apart are associated with one another. We typically plot several lags at once to observe this relationship.

Example 6.4 (Lag plots of housing sales data)

Here is a matrix of lag plots for the housing sales data.

f, aa = plt.subplots(nrows=3,ncols=4, sharex=True, sharey=True)

f.set_figheight(9)

f.set_figwidth(12)

y = hsales.hsales.values

for i in np.arange(0, 3):

for j in np.arange(0, 4):

lag = i*4 + j + 1

aa[i,j].scatter(y[:-lag], y[lag:], alpha=0.4)

aa[i,j].set_xlabel("lag " + str(lag))

f.suptitle('Lag plots');

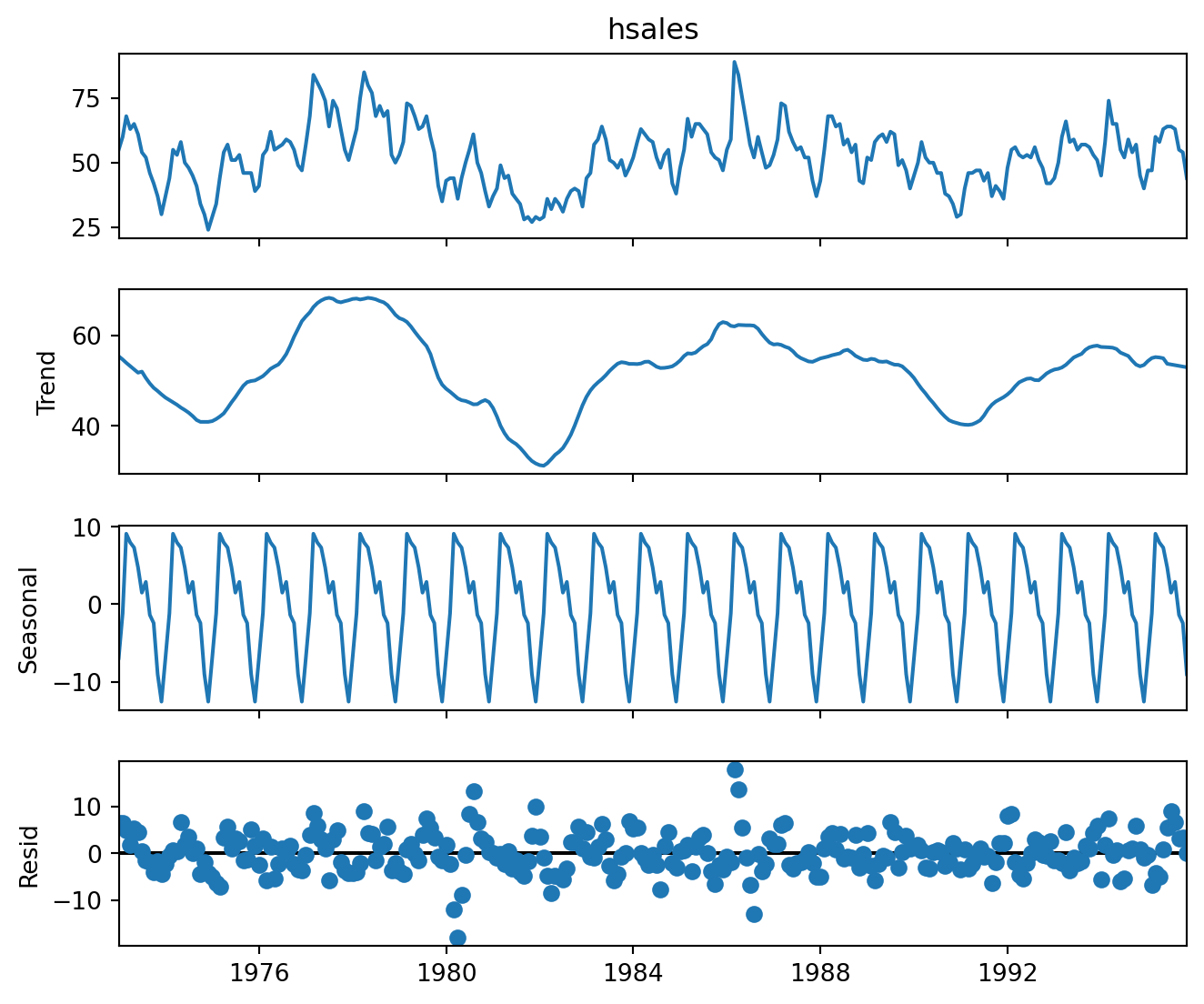

6.2 Decomposing Time Series Data

In this section, our goal is still primarily exploratory, but it will also return information that we can use to model our data later on. We aim to break the time series readings into:

- a trend-cycle component,

- a seasonal component, and

- a remainder component.

If we can forecast these components individually, we can combine them to provide forecasts for the original series (see Section 6.3.5). There are two basic methods of decomposition into the above components: an additive one, and a multiplicative one. In the additive decomposition, we assume that the components contribute in an additive manner to \(y_t\):

\[\begin{equation} y_t = S_t + T_t + R_t \end{equation}\]

In the multiplicative decomposition, we assume the following relationship holds: \[\begin{equation} y_t = S_t \times T_t \times R_t \end{equation}\]

When we are in the multiplicative case, we sometimes apply the logarithm transform to the data, which returns to an additive model: \[\begin{equation} \log y_t = \log S_t + \log T_t + \log R_t \end{equation}\]

A typical algorithm to decompose time series data would work like this:

- Estimate the trend component. Let us call it \(\hat{T}_t\).

- Obtain the de-trended data \(y_t - \hat{T}_t\) or \(y_t / \hat{T}_t\) as appropriate.

- Estimate the seasonal component. For instance, we could simply average the values in each month. Let us denote this estimate as \(\hat{S}_t\).

- Estimate the remainder component. For instance, in the additive model, it would be \(\hat{R}_t = y_t - \hat{T}_t - \hat{S}_t\).

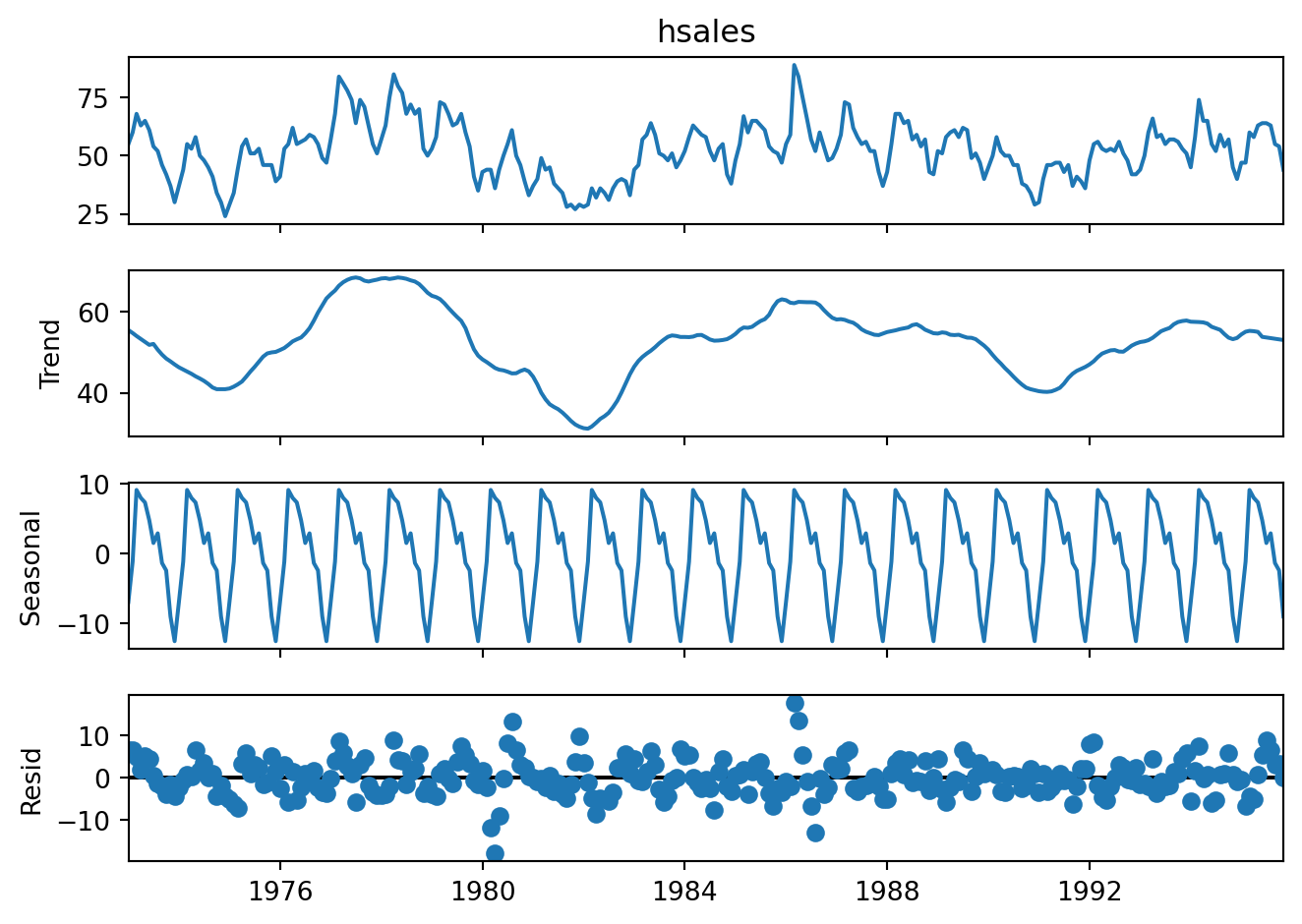

Example 6.5 (Additive decomposition, housing sales)

Here is the naive additive decomposition of the housing sales data.

When we inspect a decomposition, there are certain elements that we watch out for. One of them is to compare the range of the \(y\)-axis for the three components. In Figure 6.3, we observe that the rough spread of the trend component (second row) is about 40. On the other hand, the spread of the seasonal component (third row) is roughly 20. This suggests that the seasonal component is a significant driver of the overall variation of the process.

The fact that the seasonal pattern does not change over time is an artifact of the decomposition; it is not always a true reflection of the true pattern.

Finally, as always, we hope to see the residuals to be centred around 0, with little or no trend, and a constant variability over time.

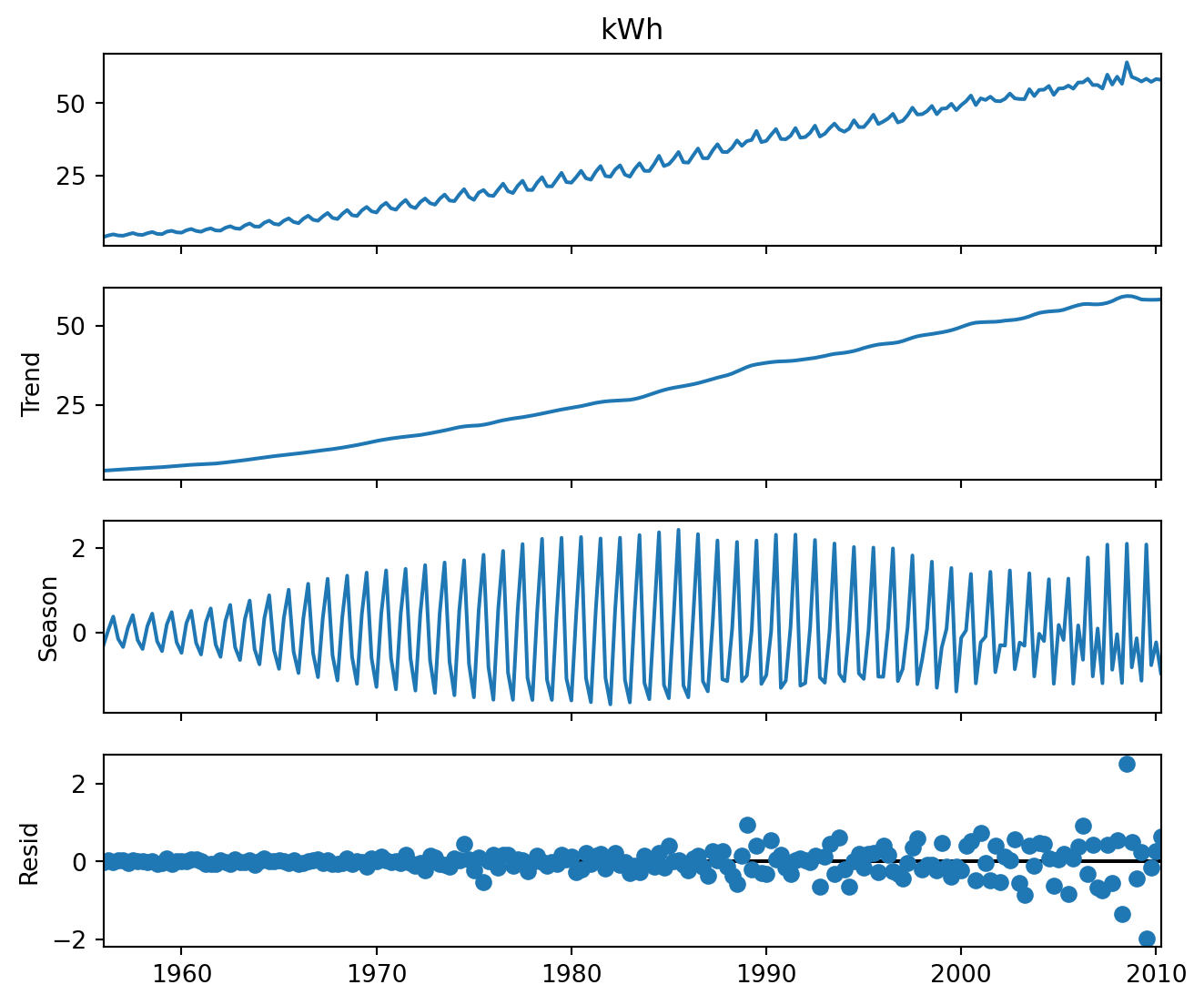

Example 6.6 (Multiplicative decomposition, Aus electricity data)

Here is the multiplicative decomposition for the Australian electric data.

qau_mult = seasonal_decompose(qau.loc[:, 'kWh'], model='multiplicative',

extrapolate_trend='freq')

ax = qau_mult.plot();

ax.set_figheight(6)

Take note that in multiplicative decompositions, the residuals are centred around 1, not zero.

As you may have noticed, there are some issues with the classical seasonal decomposition algorithms. These include:

- an inability to estimate the trend at the ends of the series.

- an inability to account for changing seasonal components.

- it is not robust to outliers.

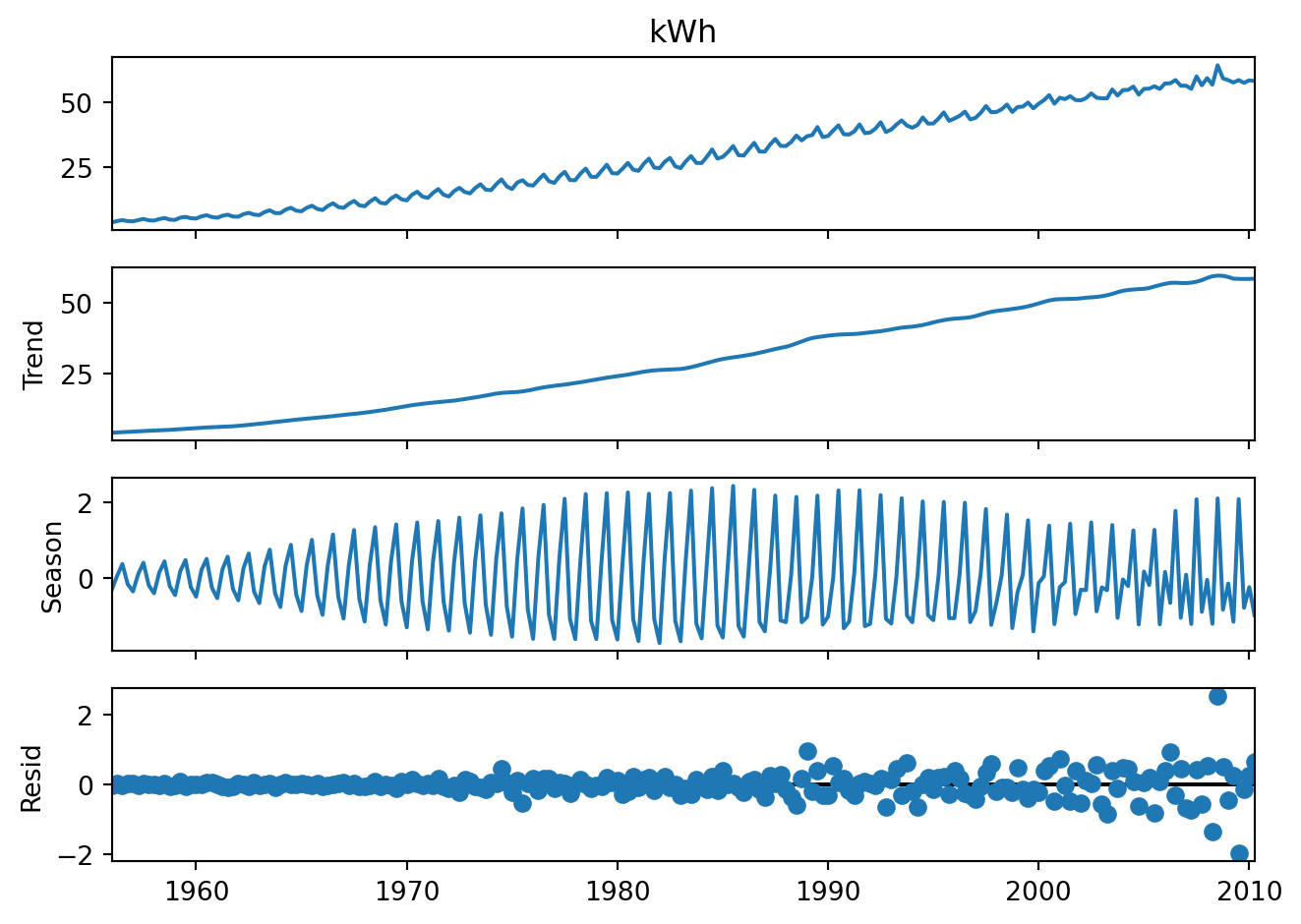

Example 6.7 (STL decomposition, Aus electricity)

Newer algorithms such as STL decomposition, X11 and others attempt to address these issues. They use locally weighted regression models to obtain the trend. These algorithms iterate over the time series several times, so as to ensure that outliers are not affecting the outcome. For full details on STL (Seasonal Trend decomposition with Loess), please refer to the original paper Cleveland et al. (1990).

Notice in Figure 6.4 how the seasonal pattern varies over time. One disadvantage of the STL decomposition, however, is that it can only return an additive decomposition.

6.3 Forecasting

Benchmark methods

As in all forecasting methods, it is useful to obtain a baseline forecast before proceeding to more sophisticated techniques. Baseline forecasts are usually obtained from simple, intuitive methods.

Take note in the sections that follow, the notation \(\hat{y}_{T+h|T}\) refers to the forecasted value of the time series at time \(T+h\), given observations until and including time \(T\).

Here are some baseline methods:

A. The simple mean forecast:

\[\begin{equation}

\hat{y}_{T+h | T} = \frac{y_1 + y_2 + y_3 + \cdots + y_T}{T}

\end{equation}\]

B. The naive forecast: \[\begin{equation} \hat{y}_{T+h | T} = y_T \end{equation}\]

C. The seasonal naive forecast.

Suppose that the season contains \(d\) periods (for instance, in monthly data, \(d=12\)). Then the seasonal naive forecast utilises the most recent observed period for the forecast:

\[\begin{equation} \hat{y}_{T+h | T} = y_{T-d+h} \end{equation}\]

Example 6.8 (Benchmark forecasts housing sales)

Suppose we apply some of the above forecasts to the housing sales dataset. We withhold the most recent 2 years of data and forecast those. Here is a plot depicting the forecasts, and the true values.

# Set aside the last two years as the test set.

#hsales = hsales.drop(columns=['year', 'month'])

train_set = hsales.iloc[:-24,]

test_set = hsales.iloc[-24:, ]

# Obtain the forecast from the training set

mean_forecast = ts.meanf(train_set.hsales, 24)

snaive_forecast = ts.snaive(train_set.hsales, 24, 12)

# Plot the predictions and true values

ax = train_set.hsales.plot(title='Benchmarks', legend=False, figsize=(12,4.5))

test_set.hsales.plot(ax=ax, legend=False, style='--')

mean_forecast.plot(ax=ax, legend=True, style='-')

snaive_forecast.plot(ax=ax, legend=False, style='-')

plt.legend(labels=['train', 'test', 'mean', 'snaive'], loc='lower right');

When assessing forecasts, there are a few different metrics that are typically applied. Each of them has it’s own set of pros and cons. If we denote the predicted value with \(\hat{y}_t\), then these are the formulas for three of the most common error metrics used in time series forecasting

A. RMSE: \[\begin{equation} \sqrt{\frac{1}{h} \sum_{i=1}^h (y_{t+i} - \hat{y}_{t+i})^2 } \end{equation}\]

B. MAE \[\begin{equation} \frac{1}{h} \sum_{i=1}^h |y_{t+i} - \hat{y}_{t+i}| \end{equation}\]

C. Mean Absolute Scaled Error

\[\begin{equation} \frac{1}{h} \sum_{i=1}^h \frac{|y_{t+i} - \hat{y}_{t+i}|}{ \frac{1}{T-1} \sum_{t=2}^T |y_t - y_{t-1}|} \end{equation}\]

The RMSE and MAE are scale dependent errors. It is difficult to compare the errors across series, or to aggregate errors across different time series with it. Due to the square in the formula, the RMSE is quite sensitive to outliers. The MAE is more robust to outliers.

The MASE is a scaled error - it allows us to compare the forecasting performance across time series. The other two metrics depend on the scale of the time series and hence do not allow us to make such comparisons.

Example 6.9 (Benchmark forecast errors)

Let us assess the forecasts made in the previous example, using RMSE and MAE.

for x in [ts.rmse, ts.mae]:

print(f"{x.__name__},mean: {x(test_set.hsales.values, mean_forecast.values):.3f}")

print(f"{x.__name__},snaive: {x(test_set.hsales.values, snaive_forecast.values):.3f}")

print('---')rmse,mean: 9.023

rmse,snaive: 5.906

---

mae,mean: 7.562

mae,snaive: 4.792

---In our simple example, the seasonal naive model outperforms the simple mean forecast according to all the metrics but in general, things are not always this clear-cut.

For reference, the MASE for the seasonal naive forecast is as follows.

ARIMA Models

Now let us turn to a huge class of models that have been utilised in time series forecasting since the 1960’s. They are known as ARIMA models. ARIMA stands for AutoRegressive Integrated Moving Average models. These models are appropriate for stationary processes. Stationarity is a technical term that refers to processes

- that have a constant mean. This means that the process merely fluctuates about a fixed level over time.

- whose covariance function does not change over time. This means that, for a fixed \(h\), the covariance between \(y_t\) and \(y_{t+h}\) is the same for all \(t\).

- whose variance is constant over time.

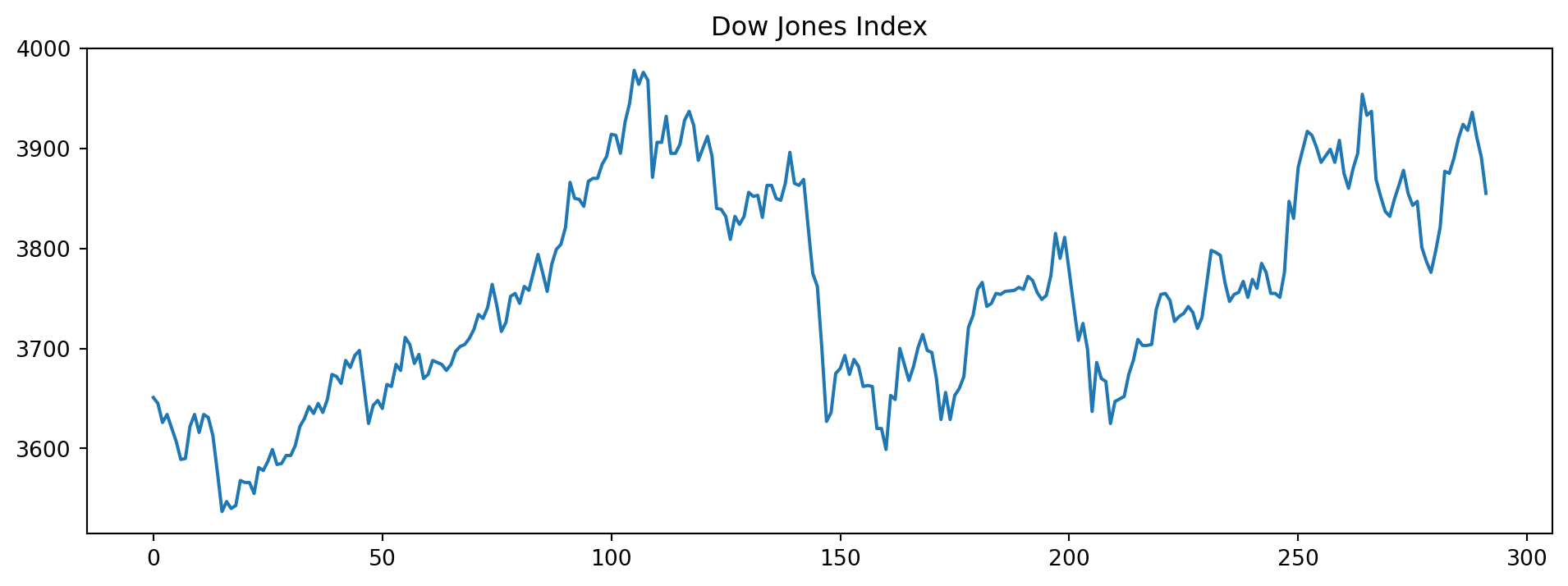

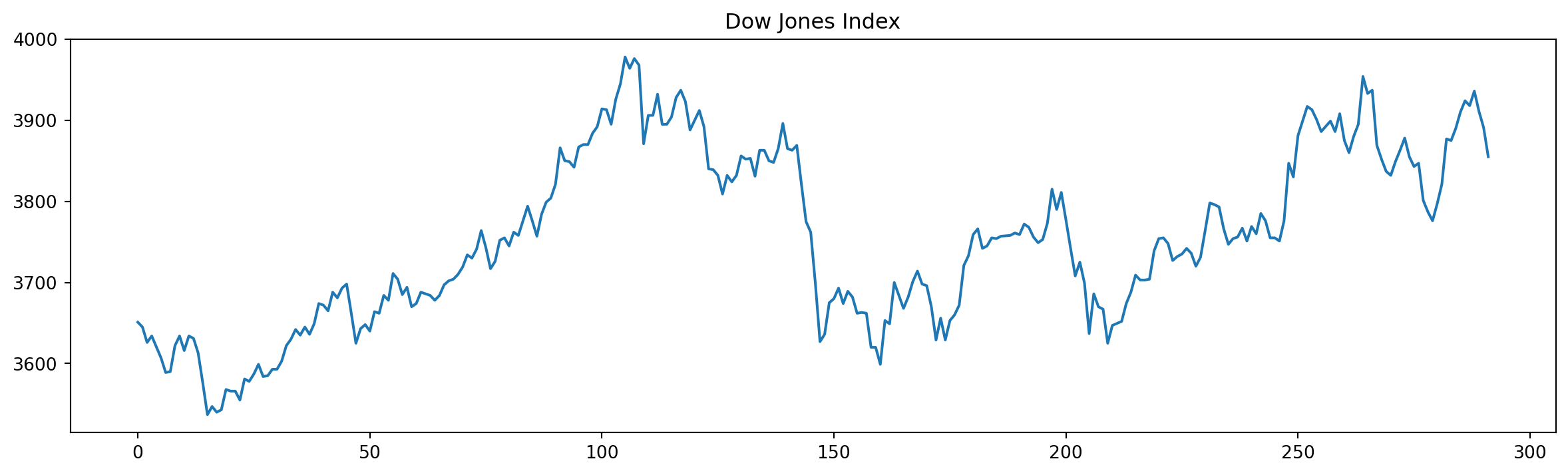

How can we tell if a process is stationary or not? The following time series is not stationary. Why?

Example 6.10 (Dow Jones index)

Consider the following time series of the Dow Jones index.

It is nonstationary because the mean (level) of the time series is not constant. However, the following differenced version of the same series is:

\[\begin{equation} \Delta y_t = y_t - y_{t-1} \end{equation}\]

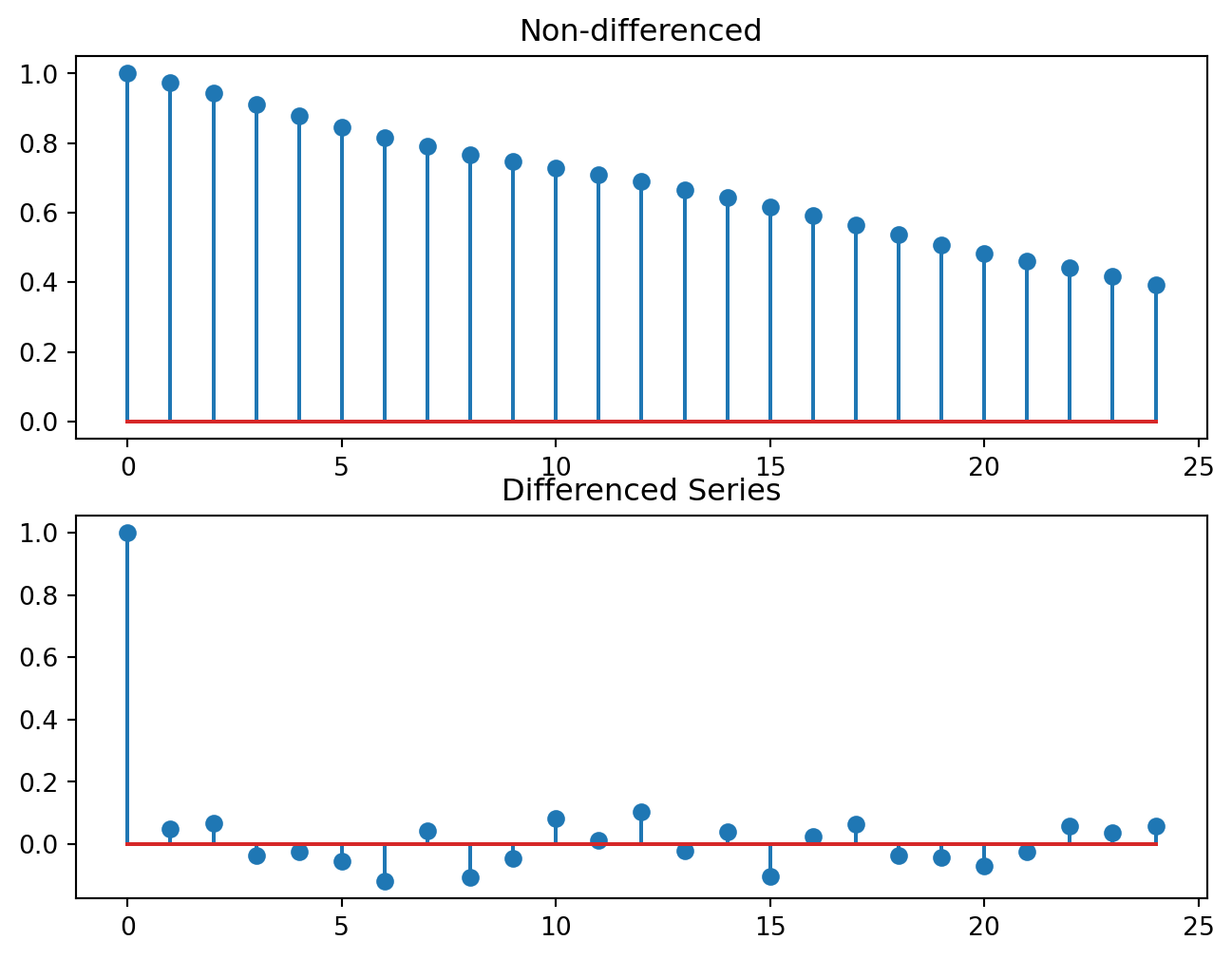

ARIMA models revolve around the idea that if we have a non-stationary series, we can transform it into a stationary one with a suitable number of differencing. A more general way of studying if a series is stationary is to plot it’s AutoCorrelation Function (ACF). The ARIMA method directly models the ACF. That is why it is so important for this class of models. The ACF of a stationary process should “die down” quickly. Figure 6.5 shows the ACF of the Dow Jones data, before and after differencing.

plt.figure(figsize=(8, 6))

plt.subplot(211)

plt.stem(acf(dj, fft=False))

plt.title("Non-differenced")

plt.subplot(212)

plt.stem(acf(ddj, fft=False));

plt.title("Differenced Series");

Now suppose that, starting from our original series \(y_t\), we difference it a sufficient number of times and obtain a stationary series. Let’s call this \(y'_t\). The ARIMA model assumes that

\[\begin{equation} y'_t = c + \phi_1 y'_{t-1} + \phi_2 y'_{t-2} + \cdots + \phi_p y'_{t-p} + \theta_1 e_{t-1} + \cdots + \theta_q e_{t-q} \end{equation}\]

- The \(e_j\) correspond to unobserved innovations. They are typically assumed to be independent across time with a common variance.

- The \(\phi\) and \(\theta\) terms are unknown coefficients to be estimated.

- If \(y'_t\) was obtained by performing \(d\) successive differencings, then the above ARIMA model is referred to as an \(\text{ARIMA}(p,d,q)\) model.

In olden days, the \(p\), \(d\) and \(q\) parameters were picked by the analyst after inspecting the ACF, PACF, and time plots of the differenced series. Today, we can iterate through a large number of them and pick the best according to a well-established criteria (AIC).

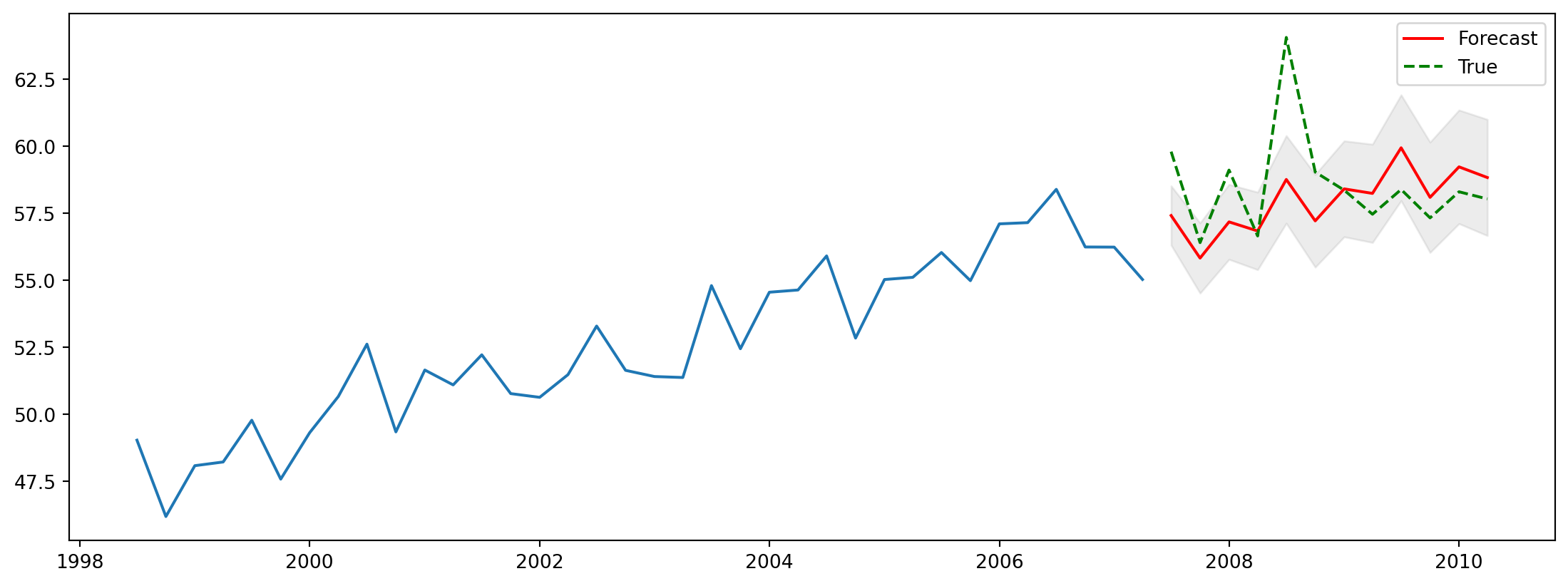

Example 6.11 (Auto ARIMA on Aus electricity)

Let us try out the ARIMA auto-fitting algorithm on the qau electricity usage dataset. We shall set aside the last three years of data as the test set. Recall that this is quarterly data. First, we establish the seasonal naive benchmark error for this dataset.

train2 = qau.kWh[:-12]

test2 = qau.kWh[-12:]

snaive_f = ts.snaive(train2, 12, 4)

print(f"The RMSE is approximately {ts.rmse(test2.values, snaive_f.values):.3f}.")The RMSE is approximately 2.545.Let us see if the automatically fitted ARIMA models can do better than this.

Here is the summary of the final chosen model.

SARIMAX Results

===========================================================================================

Dep. Variable: y No. Observations: 206

Model: SARIMAX(2, 1, 2)x(1, 0, [1], 4) Log Likelihood -175.320

Date: Sat, 11 Oct 2025 AIC 364.640

Time: 23:27:47 BIC 387.901

Sample: 0 HQIC 374.049

- 206

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.1675 0.613 -0.273 0.785 -1.369 1.034

ar.L2 0.3262 0.418 0.781 0.435 -0.492 1.145

ma.L1 -0.1472 0.604 -0.244 0.807 -1.330 1.036

ma.L2 -0.6210 0.589 -1.054 0.292 -1.776 0.534

ar.S.L4 0.9889 0.009 116.030 0.000 0.972 1.006

ma.S.L4 -0.6195 0.085 -7.310 0.000 -0.786 -0.453

sigma2 0.3110 0.026 12.139 0.000 0.261 0.361

===================================================================================

Ljung-Box (L1) (Q): 0.19 Jarque-Bera (JB): 21.89

Prob(Q): 0.67 Prob(JB): 0.00

Heteroskedasticity (H): 9.53 Skew: -0.09

Prob(H) (two-sided): 0.00 Kurtosis: 4.59

===================================================================================

Warnings:

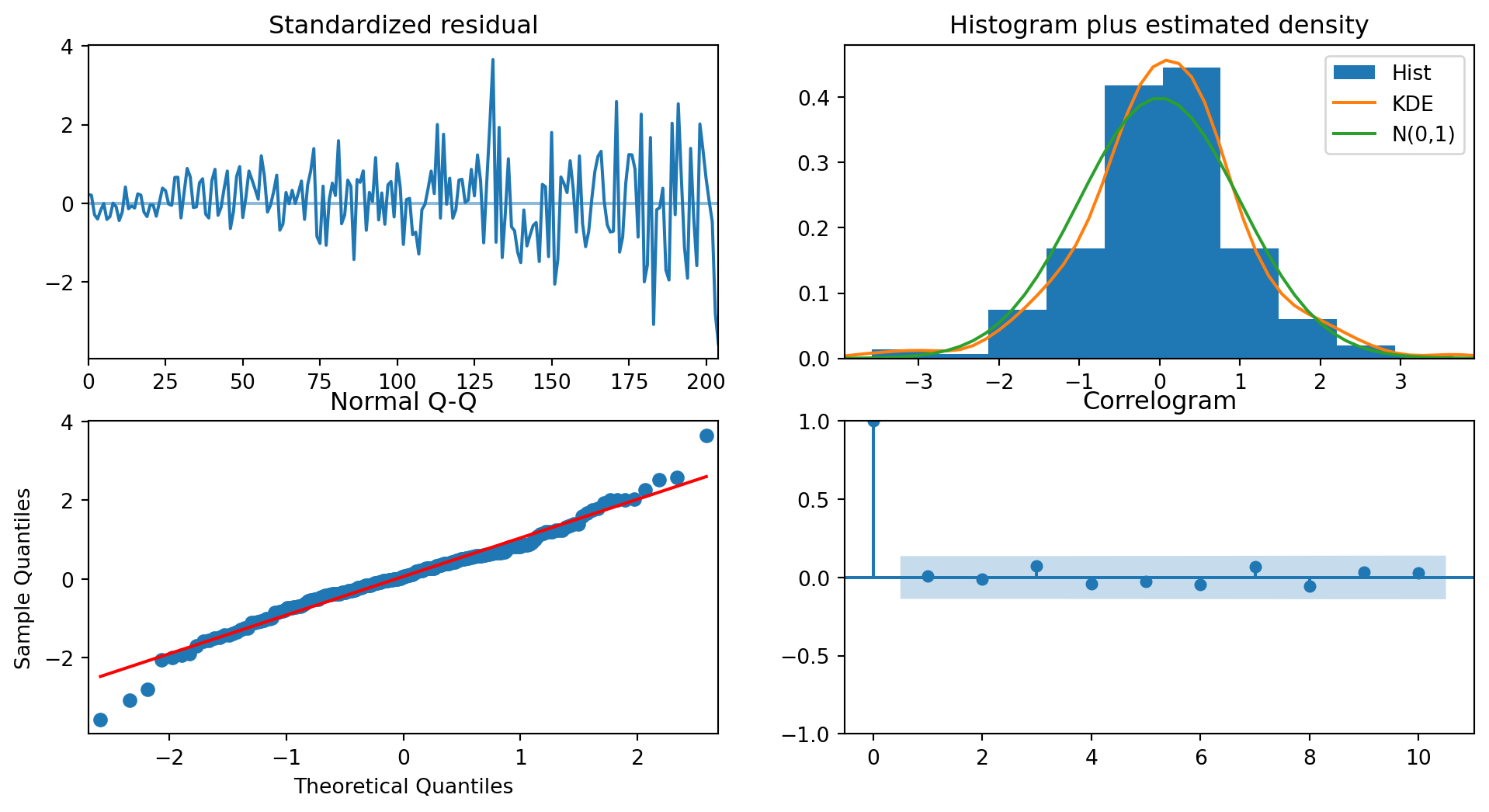

[1] Covariance matrix calculated using the outer product of gradients (complex-step).The output indicates that a seasonal ARIMA model has been found to be the best one. The column coef contains estimates of the parameters in the model. The section below contains information on statistical tests

- for Normality on the residuals (Ljung-Box and Jarque-Bera), and

- for constant variance.

In addition to tests, we should always create plots to assess the validity of residuals.

Once we have found the best-fitting model, we do what we do with any other model in data analytics: we have to inspect the residuals. The residuals should look like trash to us - there should be no clues about the data in them. With reference to Figure 6.6, the standardized residual in the top left should be consistently wide; it isn’t. In fact this information is also reflected in the model output summary (see Heteroskedasticity (H)). This suggests some sort of transformation of the data before modeling might be appropriate.

The two plots on the off-diagonal are meant for us to assess if the residuals are Normally distributed with mean 0. They do indeed look like it.

The final plot, in the bottom right, displays an ACF with no spikes, indicating that the residuals are uncorrelated. This is precisely what we wished to see.

Finally, we assess the error on the test set. The out-of-sample performance is better than the naive methods.

rmse1 = ts.rmse(test2.values, arima_m1.predict(n_periods=12))

mase1 = ts.mase(test2.values, arima_m1.predict(n_periods=12),

train2.values, seasonality=4)

print(f"The RMSE on the test set is {rmse1:.3f}.")

print(f"The MASE on the test set is {mase1:.3f}.") The RMSE on the test set is 1.929.

The MASE on the test set is 1.245.Let us proceed to make a plot of the predictions.

n_periods = 12

fc, confint = arima_m1.predict(n_periods=n_periods, return_conf_int=True)

ff = pd.Series(fc, index=test2.index)

lower_series = pd.Series(confint[:, 0], index=test2.index)

upper_series = pd.Series(confint[:, 1], index=test2.index)

plt.figure(figsize=(14, 5))

plt.plot(train2[-36:])

plt.plot(ff, color='red', label='Forecast')

plt.fill_between(lower_series.index, lower_series, upper_series, color='gray', alpha=.15)

plt.plot(test2, 'g--', label='True')

plt.legend();

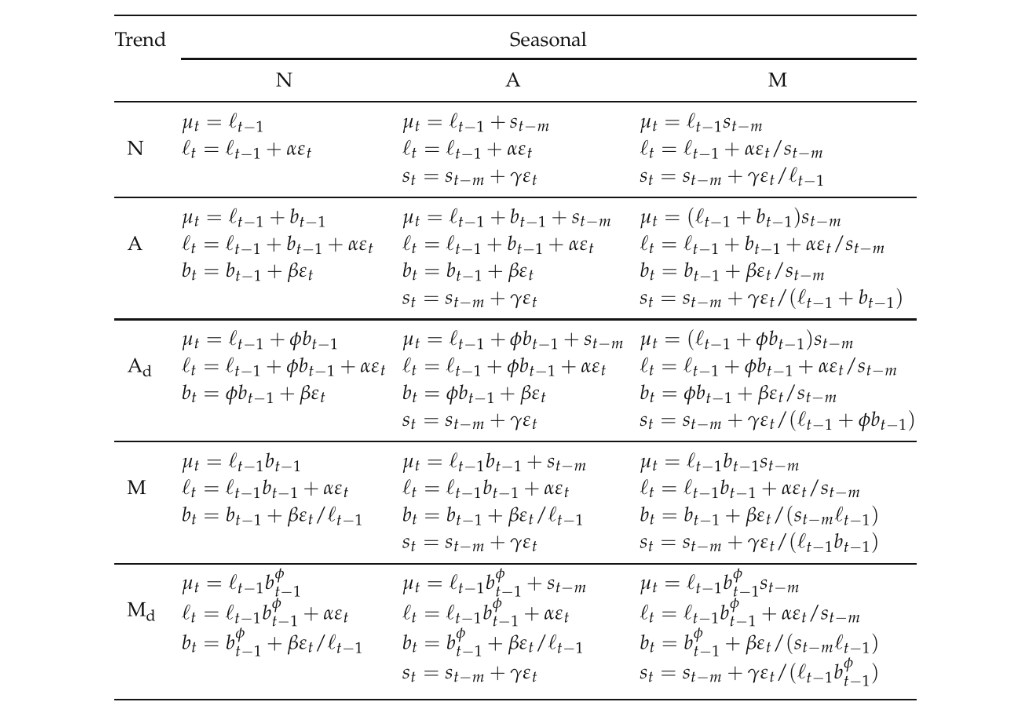

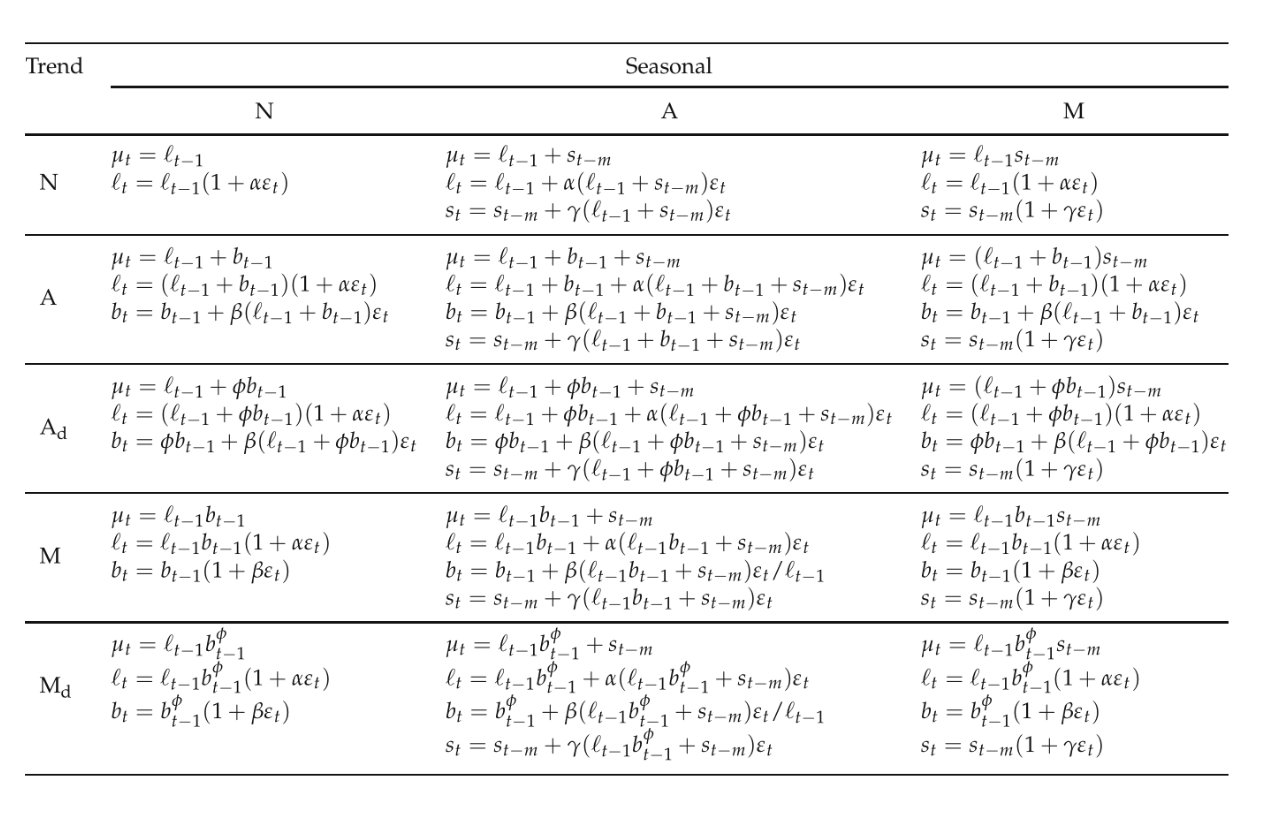

ETS

ETS models are a new class of models, that define a time series process according to a set of state space equations:

\[\begin{eqnarray} y_t &=& w' x_{t-1} + e_t \\ x_t &=& F x_{t-1} + g e_t \end{eqnarray}\]

The unobserved state \(x_t\) is usually a vector, and it typically contains information about

- the level of the process at time \(t\).

- the seasonal effect at time \(t\)

- the trend or growth factor at time \(t\).

All these parameters are updated at every point in time. For instance, the simplest ETS model (A,N,N), is one that assumes that there is only a level parameter, and that it is updated as a weighted average of the most recent levels:

\[\begin{eqnarray} l_t &=& \alpha y_t + (1- \alpha)l_{t-1} \\ \hat{y}_{t+1} &=& l_t \end{eqnarray}\]

The definition of the model is very flexible, and allows multiplicative growth, linear growth and damped terms in the model. All this, in addition to not requiring the assumption of stationarity!

Figure 6.8 contains a full table of the additive models, while Figure 6.9 contains the multiplicative models. They were taken from Hyndman and Athanasopoulos (2018).

Example 6.12 (ETS model on Aus electricity dataset)

Let us try one of the basic models, with just a slope, level and seasonal effect ETS(A,A,A), on the qau dataset.

ets_m1 = ExponentialSmoothing(train2.values, seasonal_periods=4, trend='add',

seasonal='add')

ets_fit = ets_m1.fit()

print(ets_fit.summary()) ExponentialSmoothing Model Results

================================================================================

Dep. Variable: endog No. Observations: 206

Model: ExponentialSmoothing SSE 64.907

Optimized: True AIC -221.915

Trend: Additive BIC -195.292

Seasonal: Additive AICC -220.787

Seasonal Periods: 4 Date: Sat, 11 Oct 2025

Box-Cox: False Time: 23:27:48

Box-Cox Coeff.: None

=================================================================================

coeff code optimized

---------------------------------------------------------------------------------

smoothing_level 0.6205891 alpha True

smoothing_trend 1.4395e-11 beta True

smoothing_seasonal 0.2690339 gamma True

initial_level 4.0245281 l.0 True

initial_trend 0.2509921 b.0 True

initial_seasons.0 -0.3901302 s.0 True

initial_seasons.1 0.1114788 s.1 True

initial_seasons.2 0.2913054 s.2 True

initial_seasons.3 -0.3722268 s.3 True

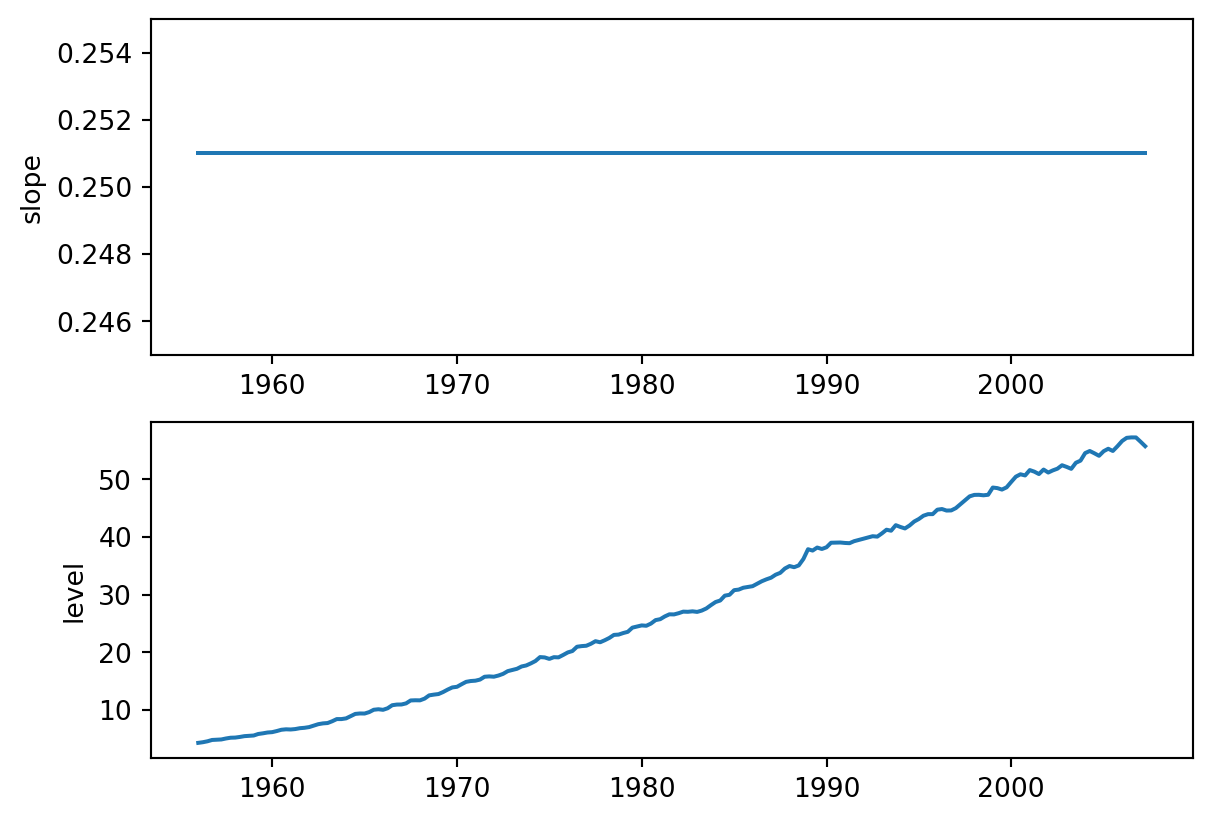

---------------------------------------------------------------------------------The plots in Figure 6.10 plot the estimated trend and level for the series. Notice how there is an almost constant slope for the series.

plt.subplot(211)

plt.plot(train2.index, ets_fit.trend, scaley=False)

plt.ylim(0.245, 0.255)

plt.ylabel('slope')

plt.subplot(212)

plt.plot(train2.index, ets_fit.level)

plt.ylabel('level');

Finally, let’s take a look if the predictions on the test set are competitive with the automatic ARIMA model that was selected earlier. The forecasts are better than the naive ones, but not as good as the ARIMA. However, keep in mind that we are working with a single model - just as we did for ARIMA models, we should iterate over several ETS models and pick the best one in order to compare with the ARIMA model found.

Theta Method

The Theta method is a forecasting approach that has proved to be quite effective in competitions. It regularly appears as one of the best-performing models. Instead of decomposing a time series into Trend, Season and Remainder terms, the theta method decomposes a seasonally adjusted time series into short- and long-term components. The full reference for this method is Assimakopoulos and Nikolopoulos (2000).

Suppose we are interested in forecasting a time series \(\{y_t\}\). The theta decomposition is based on the concept of amplifying/diminishing the local curvatures of the time series. This is brought about through a coefficient \(\theta\); hence the name of the model.

As a preview, we are going to find series \(\{ x_{\theta,t}\}\) and \(\{ x_{1 - \theta,t}\}\) such that

\[ y_t = \frac{1}{2}(x_{\theta,t} + x_{1 - \theta,t}) \]

In order to forecast \(y_t\), we shall forecast \(\{ x_{\theta,t}\}\) and \(\{ x_{1 - \theta,t}\}\) separately and then combine them. There are numerous possible pairs of \(\{ x_{\theta,t}\}\) and \(\{ x_{1 - \theta,t}\}\) that we can use. However the most common one is where \(x_\theta\) corresponds to a straight line OLS fit, and \(x_{1 - \theta}\) corresponds to a version of the time series with its curvature amplified.

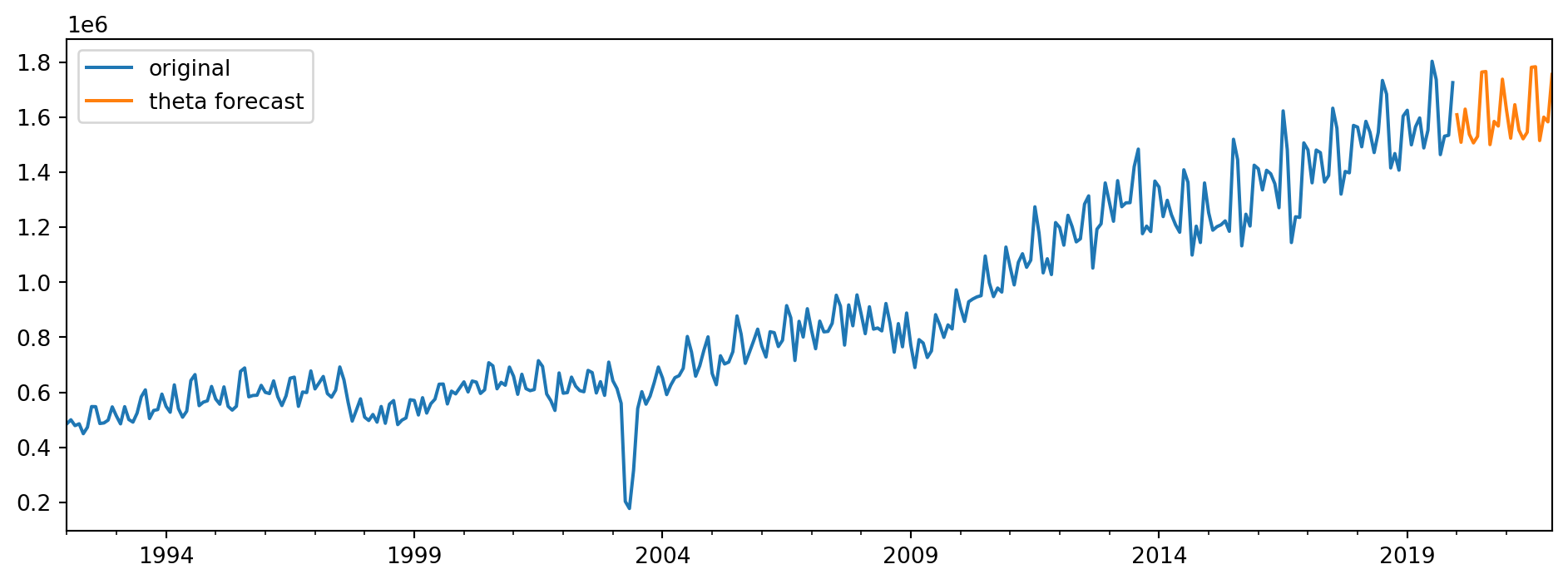

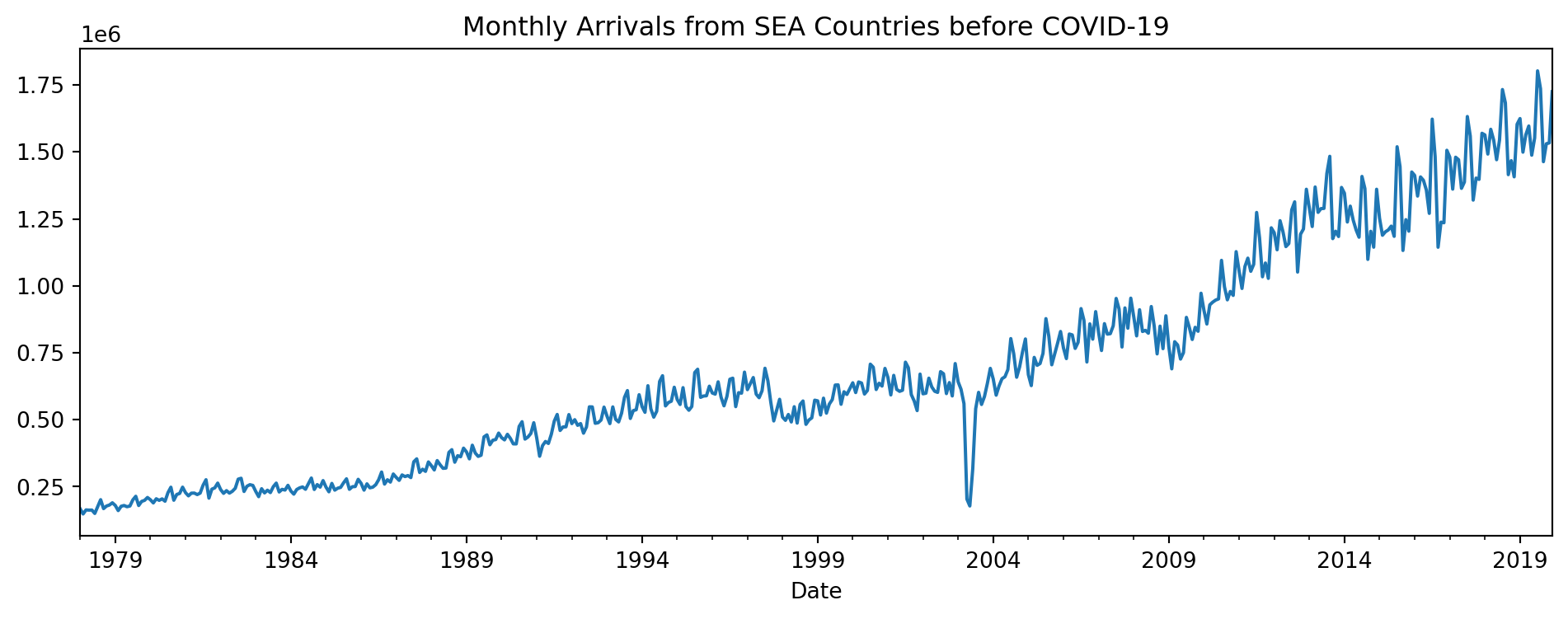

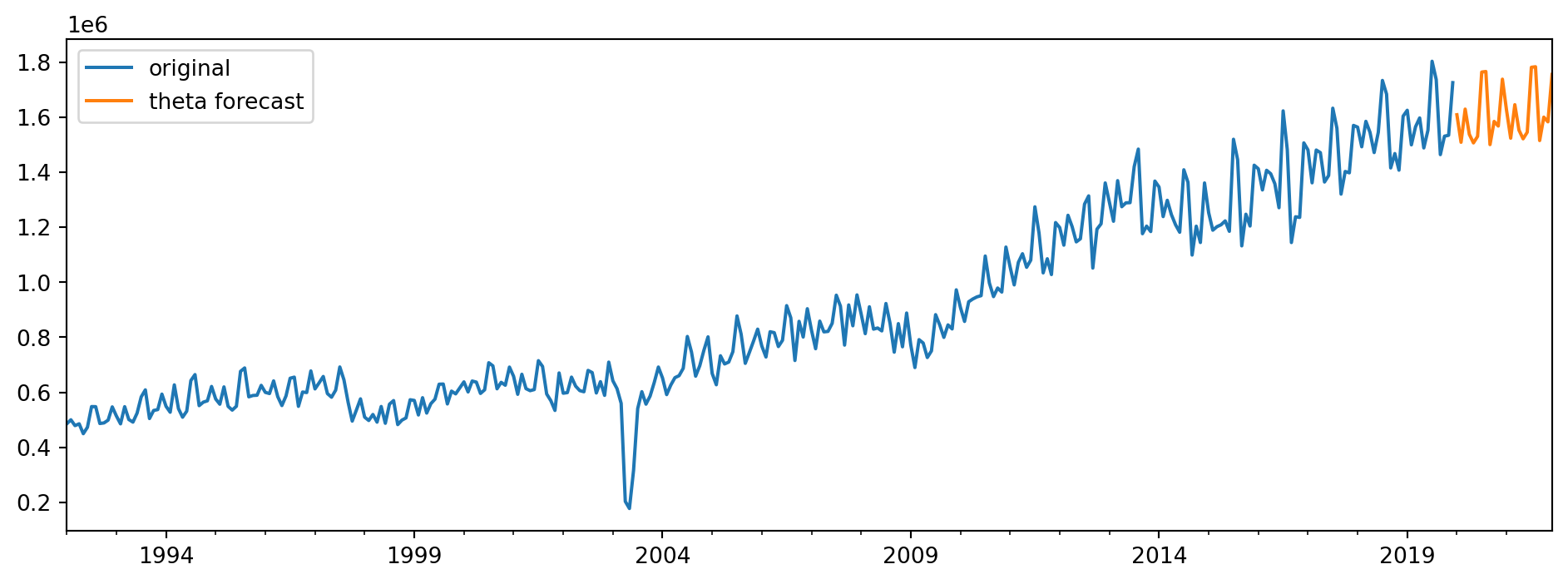

Example 6.13 (International tourism arrivals to Singapore)

The Singapore Department of Statistics shares information on tourist arrivals to Singapore at the monthly level. Here is a time series plot of arrivals from South East Asian Countries:

tourism = pd.read_excel("data/international_visitor_arrivals_sg.xlsx",

parse_dates=[0], date_format="%Y %b",

na_values='na')

sea_tourism = tourism.iloc[:, 0:9]

sea_tourism.columns = ['Date', 'SEA', 'Brunei', 'Indonesia' ,'Malaysia',

'Myanmar', 'Philippines', 'Thailand', 'Vietnam']

sea_tourism.Date = sea_tourism.Date.str.replace(' ', '')

sea_tourism.Date = pd.to_datetime(sea_tourism.Date, format="%Y %b")

sea_tourism.set_index('Date', inplace=True)

sea_tourism.sort_index(inplace=True)

sea_tourism.index.freq = 'MS'

sea2 = sea_tourism.SEA[sea_tourism.index < datetime.datetime(2020, 1, 1)]

fig = sea2.plot(figsize=(12,4));

fig.set_title('Monthly Arrivals from SEA Countries before COVID-19');

The data was obtained from the Department of Statistics. Take note that we are only going to focus on pre-COVID data.

To fit the theta model for this dataset, we use the following code:

ThetaModel Results

==============================================================================

Dep. Variable: SEA No. Observations: 504

Method: OLS/SES Deseasonalized: True

Date: Sat, 11 Oct 2025 Deseas. Method: Multiplicative

Time: 23:27:50 Period: 12

Sample: 01-01-1978

- 12-01-2019

Parameter Estimates

========================

Parameters

------------------------

b0 2628.8595906871597

alpha 0.8383848338839772

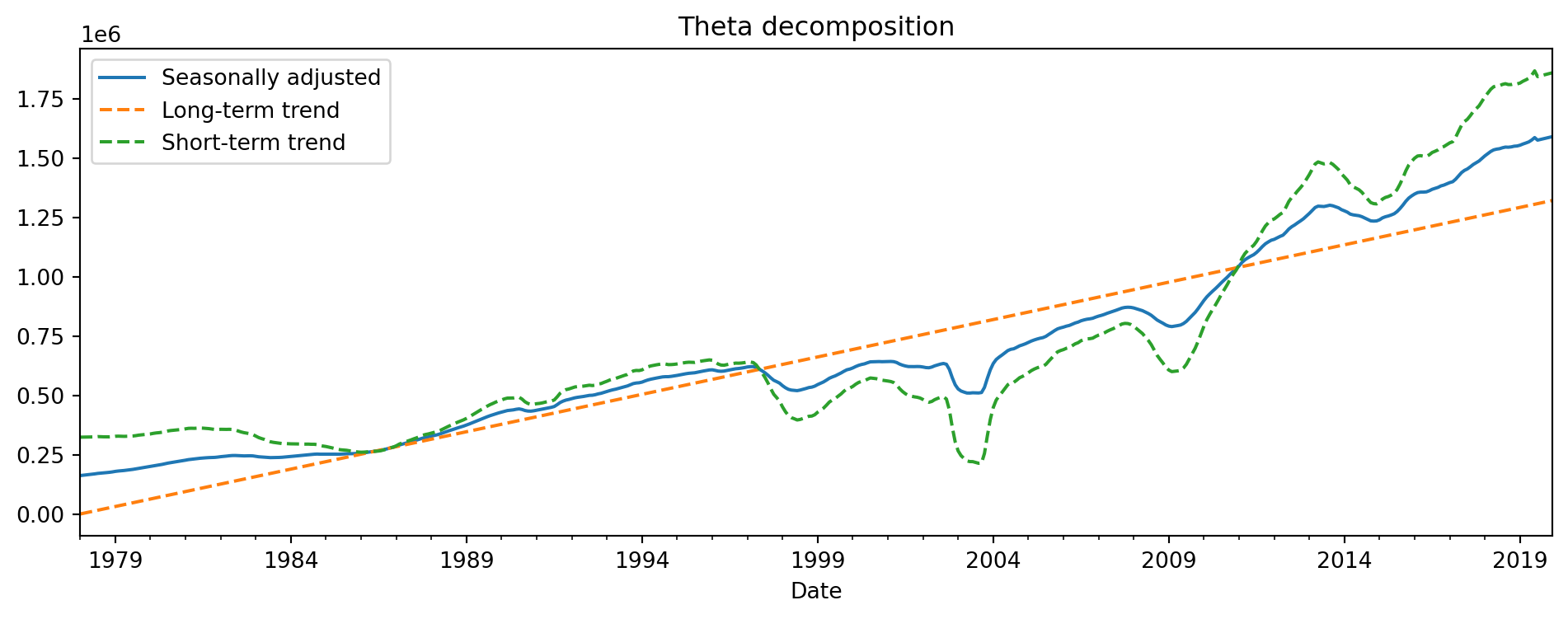

------------------------Here is what the two components from the model look like, in comparison to the seasonally adjusted series (based on a multiplicative decomposition).

The calculations in the next cell are based on formulas for the theta decomposition that we won’t get into. They are just for illustration of how the decomposition is in terms of long and short term trends, rather than the cross-sectional decompositions we have been dealing with so far. The orange dashed line in Figure 6.11 denotes the long-term trend that the model has identified, while the green dashed line denotes the short-term trend. The blue solid line is the seasonally adjusted time series.

# carry out mutliplicative decomposition in order to obtain seasonally adjusted series

sea2_mult = seasonal_decompose(sea2, model='multiplicative', extrapolate_trend='freq')

# get long-term trend slope and intercept

a0 = (sea2.mean() - theta_mod_fit.params['b0']*(503)/2)/1e6

xvals = np.arange(1, 505)

yvals1 = a0 + theta_mod_fit.params['b0']*(xvals - 1)

yvals1 = pd.Series(data=yvals1, index=sea2.index)

# get short term trend series

a2 = -1*a0

b2 = -1*theta_mod_fit.params['b0']

yvals2 = a2 + b2*(xvals - 1) + 2*(sea2_mult.resid + sea2_mult.trend)

yvals2 = pd.Series(data=yvals2, index=sea2.index)

fig = (sea2_mult.resid + sea2_mult.trend).plot(label='Seasonally adjusted',

legend=True, figsize=(12,4));

yvals1.plot(legend=True, label='Long-term trend', style="--")

yvals2.plot(legend=True, label='Short-term trend', style="--");

fig.set_title("Theta decomposition");

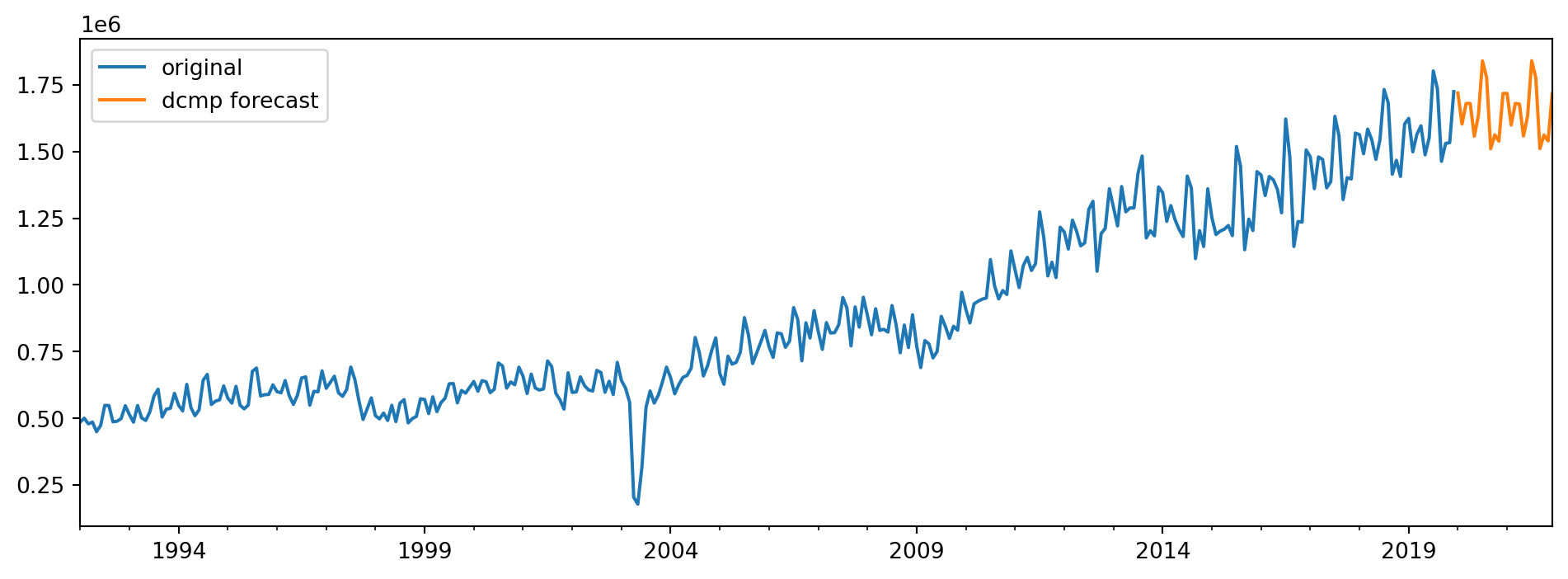

Finally, we visualise the forecasts from this theta decomposition model. We only plot the final 360 observations for the visualisation.

Forecasting with Seasonal Decomposition

Continuing with the tourism data, we demonstrate how we can utilise a seasonal decomposition (not theta decomposition) model to make forecasts. Recall that a seasonal decomposition breaks the series down into the trend, seasonal and residual components. Seasonal decompositions are typically used to study a time series, but they can also be used to make forecasts. One approach is to use either ARIMA or ETS to predict the seasonally adjusted component, and then to use a seasonal naive model to predict the seasonal component. These two forecasts will then be combined to create the final forecast.

Example 6.14 (Tourism forecasts with decomposition)

Here is the code that will use and STL model to decompose the series, and fit a pre-chosen ARIMA(3,1,2) model to the seasonally adjusted series.

stlf = STLForecast(sea2, ARIMA, model_kwargs={"order": (3, 1, 2)})

res = stlf.fit( )

forecasts2 = pd.DataFrame(

{

"original": sea2,

"dcmp forecast": res.forecast(24)

}

)

forecasts2.tail(360).plot(figsize=(12,4));/home/viknesh/NUS/coursesTaught/ind5003-book/env/lib/python3.10/site-packages/statsmodels/tsa/statespace/sarimax.py:966: UserWarning:

Non-stationary starting autoregressive parameters found. Using zeros as starting parameters.

6.4 Miscellaneous Topics

Time Series Clustering

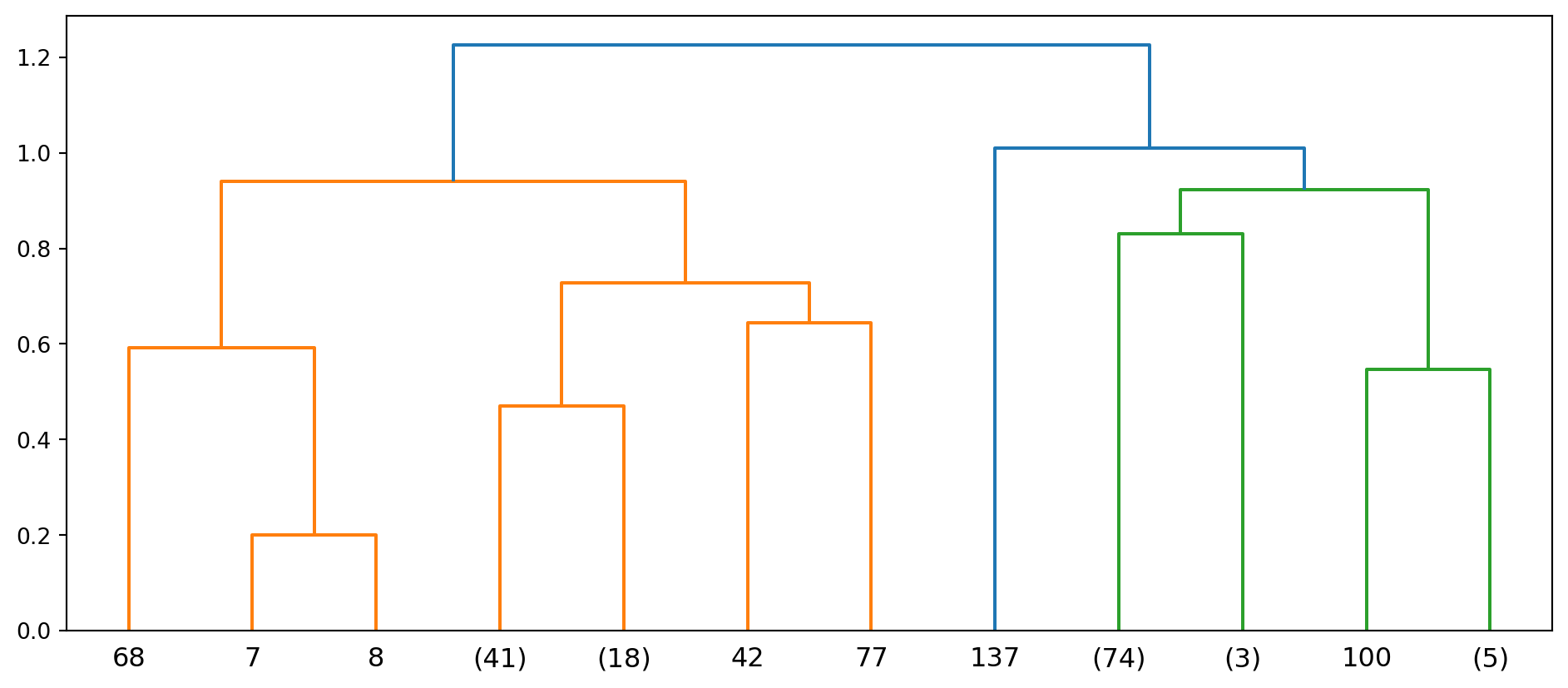

Example 6.15 (Time series clustering, US employment data)

The Forecasting: Principles and Practice contains time series data on employment in various sectors in the US. There are 148 unique series in the dataset.

us_employment = pd.read_csv("data/us_employment.csv", parse_dates=[0],

date_format="%Y %b")

series_ids = us_employment.Series_ID.unique()

us_employment.sample(n=8)| Month | Series_ID | Title | Employed | |

|---|---|---|---|---|

| 104968 | 1965-05-01 | CEU6056140001 | Professional and Business Services: Business S... | NaN |

| 106594 | 1939-05-01 | CEU6056200001 | Professional and Business Services: Waste Mana... | NaN |

| 27590 | 1977-03-01 | CEU3133440001 | Durable Goods: Semiconductors and Electronic C... | NaN |

| 138542 | 2017-09-01 | CEU9092200001 | Government: State Government, Excluding Education | 2686.6 |

| 19103 | 1996-09-01 | CEU3100000001 | Durable Goods | 10535.0 |

| 14398 | 2008-05-01 | CEU2023700001 | Construction: Heavy and Civil Engineering Cons... | 1002.3 |

| 87900 | 1996-07-01 | CEU5552211001 | Financial Activities: Commercial Banking | 1285.9 |

| 2235 | 1963-10-01 | CEU0800000001 | Private Service-Providing | 28394.0 |

Here is a plot of one of the time series in the dataset.

us_employment[us_employment.Title == "Total Private"].plot(x='Month',

y='Employed',

figsize=(12,4));

Since we are going to perform clustering on the time series data, our first step is to remove the missing values.

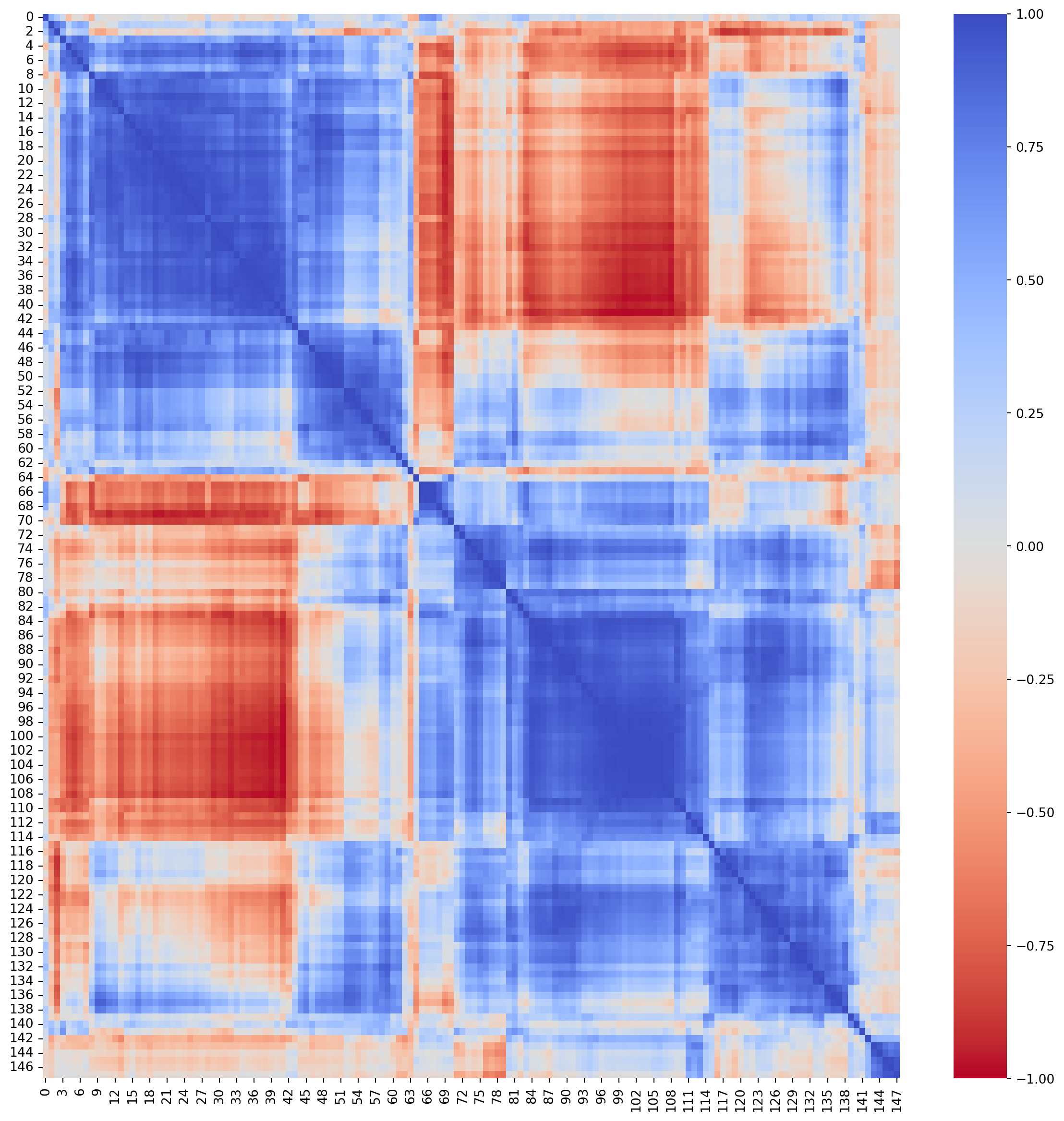

Now we can begin the clustering procedure. The first line in the code below generates a 148 x 148 distance matrix.

out = pdist(us2_array, metric='correlation')

lm1 = hierarchy.linkage(out, method='average', optimal_ordering=True)

plt.figure(figsize=(12,5))

hierarchy.dendrogram(lm1, p=3, truncate_mode='level',color_threshold=True);

We reorder the columns and rows in the matrix so that similar time series appear next to one another.

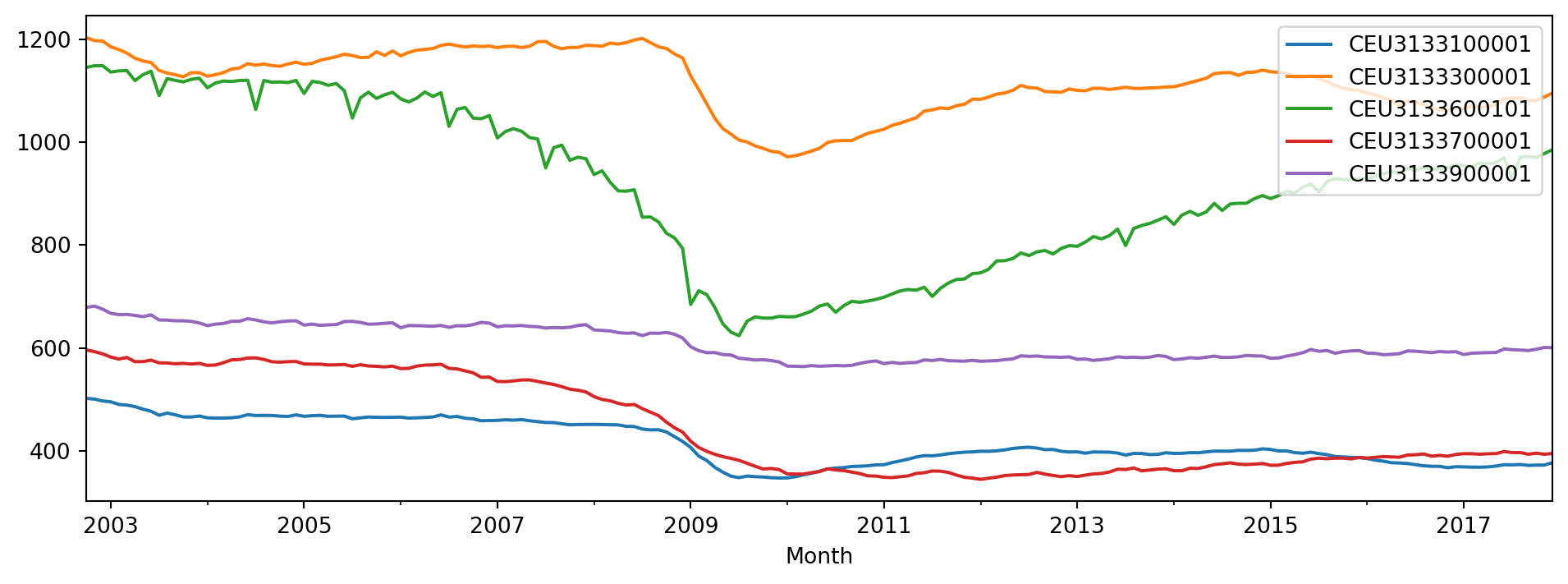

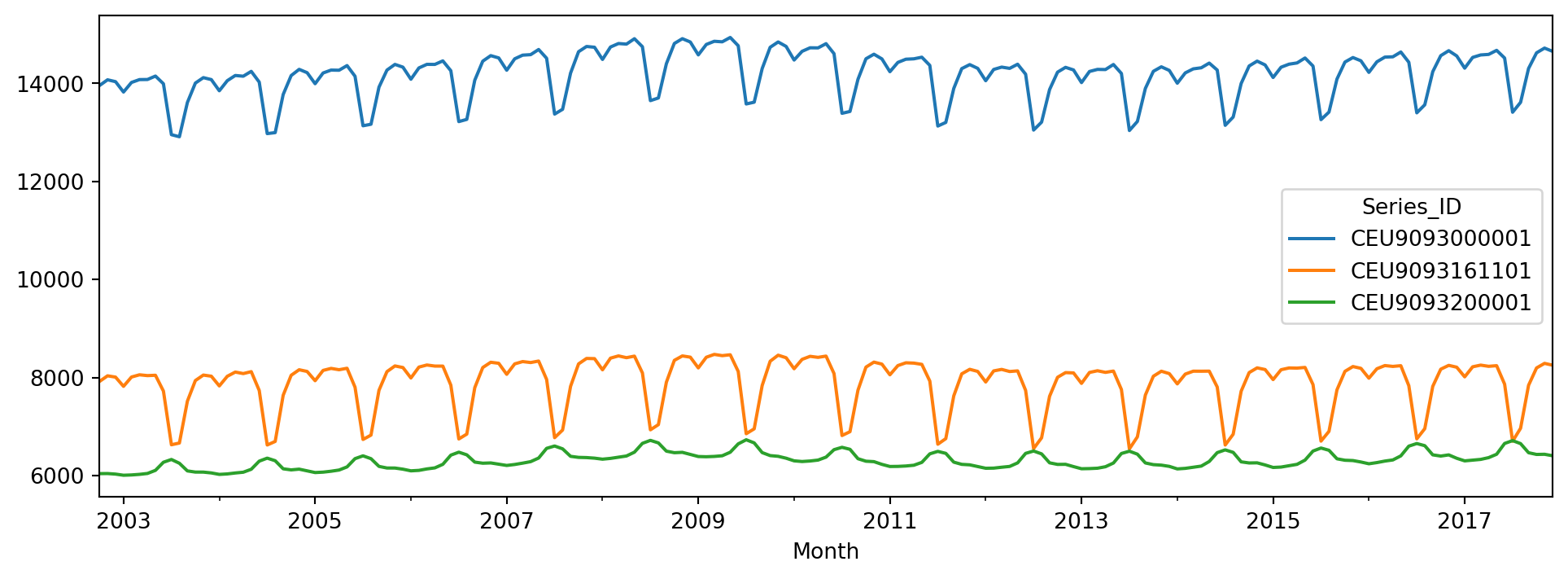

In the next few plots, we use the heatmap in Figure 6.12 to pick out series that are close to one another. Series in blue segments of the matrix are highly correlated; here we inspect them to try to characterise the similarity.

The series in Figure 6.13 seem to have a dip around the period 2009 - 2011, while those in Figure 6.14 have a cyclical pattern.

6.5 Summary

We have briefly covered the following time series concepts: Exploratory data analysis, assessing point forecasts and a few commonly used models. To finish up the section, we also applied clustering to time series. With today’s code, the model-fitting routines are easier to run. As always, the onus is on us as analysts to inspect the residuals from the models to understand the time series we are working with.

6.6 References

Stats models pages

Forecasting principles and practice

Although the code for this textboook uses R, the concepts are very well explained. It is written by one of the foremost experts in time series forecasting methods. The reference is Hyndman and Athanasopoulos (2018).